Enhanced Safety Protocols

Safety remains a paramount concern in manufacturing environments, and immersive technology-in-manufacturing market solutions are increasingly being adopted to enhance safety protocols. By utilizing VR and AR, companies can simulate hazardous scenarios and train employees in a controlled environment, thereby reducing the risk of accidents. In South America, where industrial safety regulations are becoming more stringent, the adoption of immersive technologies is expected to rise. Reports indicate that companies implementing these technologies have seen a reduction in workplace accidents by up to 30%. This focus on safety not only protects employees but also minimizes operational disruptions, making immersive technology a vital component in the manufacturing sector.

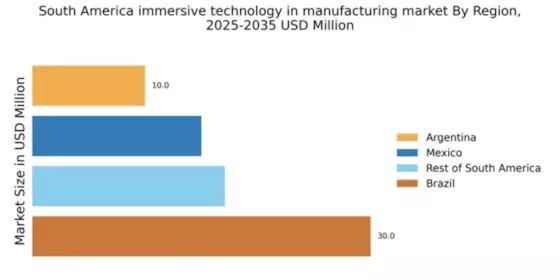

Growing Investment in R&D

Investment in research and development (R&D) is a crucial factor propelling the immersive technology-in-manufacturing market forward. South American manufacturers are increasingly allocating resources to explore innovative applications of immersive technologies. This trend is evident as companies seek to develop customized solutions that cater to specific industry needs. The South American government has also recognized the importance of technological advancement, offering grants and incentives for R&D initiatives. As a result, the immersive technology sector is likely to witness a surge in innovative products and services, fostering a competitive landscape that benefits the manufacturing industry.

Cost Reduction Initiatives

Cost efficiency is a critical driver for the immersive technology-in-manufacturing market, particularly in South America, where manufacturers face intense competition. The implementation of immersive technologies can lead to significant cost savings by optimizing production processes and reducing waste. For instance, AR can assist in maintenance tasks, allowing technicians to visualize complex machinery components, which can decrease repair times and costs. A study indicates that companies utilizing immersive technologies have reported a reduction in operational costs by approximately 20%. This financial incentive encourages manufacturers to adopt immersive solutions, thereby driving growth in the market.

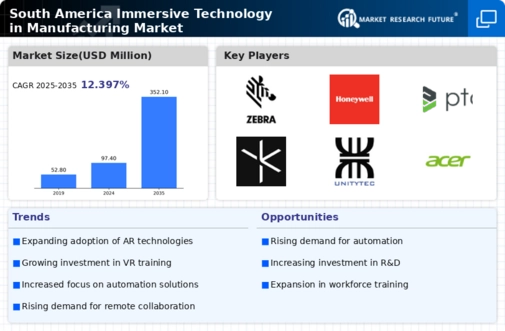

Rising Demand for Automation

The increasing demand for automation in manufacturing processes is a key driver for the immersive technology-in-manufacturing market. As industries in South America strive for efficiency and productivity, the integration of immersive technologies such as virtual reality (VR) and augmented reality (AR) becomes essential. These technologies facilitate real-time monitoring and control of manufacturing operations, leading to reduced downtime and enhanced operational efficiency. According to recent data, the automation market in South America is projected to grow at a CAGR of 10% from 2025 to 2030, indicating a robust shift towards automated solutions. This trend suggests that manufacturers are likely to invest in immersive technologies to streamline their operations and remain competitive in a rapidly evolving market.

Shift Towards Sustainable Practices

The shift towards sustainability in manufacturing is significantly influencing the immersive technology-in-manufacturing market. South American manufacturers are increasingly adopting eco-friendly practices, and immersive technologies play a pivotal role in this transition. By utilizing AR and VR, companies can optimize resource usage and minimize waste during production processes. Furthermore, immersive simulations can aid in designing more sustainable products. Reports suggest that manufacturers focusing on sustainability are likely to see a 15% increase in consumer preference, indicating a market trend that aligns with environmental consciousness. This growing emphasis on sustainability is expected to drive the adoption of immersive technologies in the manufacturing sector.