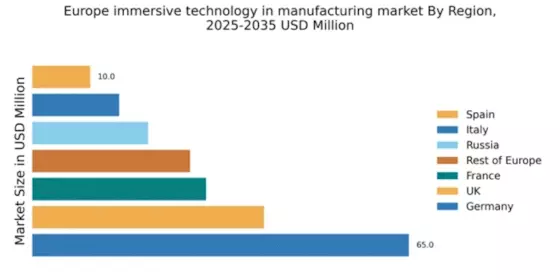

Germany : A Hub for Innovation and Growth

Key markets include cities like Munich, Stuttgart, and Berlin, which are home to major manufacturing hubs. The competitive landscape features prominent players such as Siemens and Dassault Systèmes, driving innovation and collaboration. Local market dynamics are characterized by a strong emphasis on sustainability and efficiency, with applications spanning automotive, aerospace, and machinery sectors. The business environment is favorable, supported by favorable regulatory frameworks and incentives for tech adoption.

UK : Innovation Driven by Industry Needs

Key markets include London, Birmingham, and Manchester, which are pivotal for manufacturing and technology. The competitive landscape features major players like PTC and Microsoft, fostering a vibrant tech community. Local market dynamics emphasize collaboration between academia and industry, with applications in sectors such as healthcare and construction. The business environment is dynamic, with a strong emphasis on research and development.

France : Fostering Innovation in Manufacturing

Key markets include Paris, Lyon, and Toulouse, which are central to France's manufacturing landscape. The competitive environment features players like Dassault Systèmes, driving advancements in 3D modeling and simulation. Local dynamics are characterized by a strong emphasis on sustainability and digital transformation, with applications in aerospace, automotive, and energy sectors. The business environment is supportive, with various incentives for tech adoption.

Russia : Growth Amidst Challenges

Key markets include Moscow and St. Petersburg, which are central to the country's industrial activities. The competitive landscape features both local and international players, with a growing presence of companies like Honeywell. Local market dynamics are influenced by economic conditions and regulatory frameworks, with applications in sectors such as defense, energy, and heavy machinery. The business environment is evolving, with increasing support for innovation.

Italy : A Growing Market for Immersive Tech

Key markets include Milan, Turin, and Bologna, which are hubs for manufacturing and design. The competitive landscape features players like Siemens and local startups, fostering innovation. Local market dynamics emphasize collaboration between traditional industries and tech companies, with applications in fashion, automotive, and machinery sectors. The business environment is supportive, with various incentives for tech adoption and innovation.

Spain : Innovation in Diverse Industries

Key markets include Barcelona and Madrid, which are central to Spain's industrial activities. The competitive landscape features both local and international players, with a growing presence of companies like Rockwell Automation. Local market dynamics are influenced by economic conditions and regulatory frameworks, with applications in sectors such as automotive, aerospace, and energy. The business environment is evolving, with increasing support for innovation.

Rest of Europe : A Growing Landscape for Innovation

Key markets include cities across Scandinavia, the Benelux region, and Eastern Europe, which are central to the continent's industrial activities. The competitive landscape features both local and international players, with a growing presence of companies like NVIDIA and Unity Technologies. Local market dynamics are influenced by economic conditions and regulatory frameworks, with applications in sectors such as automotive, energy, and consumer goods. The business environment is evolving, with increasing support for innovation.