Increasing Cyber Threat Landscape

The identity threat-detection-response market in South America is experiencing growth due to the escalating cyber threat landscape. With a reported increase in cyber incidents, organizations are compelled to invest in advanced detection and response solutions. In 2025, it is estimated that cybercrime costs in the region could reach $150 billion, prompting businesses to prioritize identity protection. This trend indicates a heightened awareness of the need for robust security measures, as companies seek to safeguard sensitive data and maintain customer trust. The rising frequency of identity theft and data breaches further underscores the necessity for effective identity threat-detection-response strategies. As organizations navigate this complex environment, the demand for innovative solutions is likely to surge, driving market expansion and encouraging the development of more sophisticated technologies.

Rising Incidence of Identity Fraud

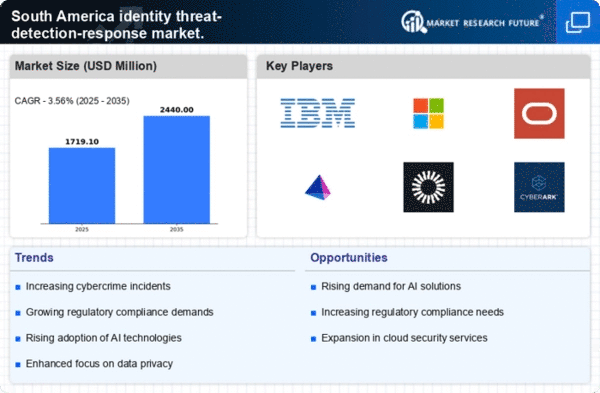

The identity threat-detection-response market in South America is being propelled by the alarming rise in identity fraud cases. Reports indicate that identity theft incidents have surged by over 30% in recent years, prompting businesses to reassess their security protocols. This trend is particularly concerning for financial institutions and e-commerce platforms, which are prime targets for cybercriminals. As organizations face increasing pressure to protect customer identities, investments in identity threat-detection-response solutions are expected to rise. In 2025, the market is projected to grow by 25%, driven by the urgent need for effective fraud prevention measures. This growing awareness of identity fraud risks is likely to shape the strategies of businesses, leading to a more proactive approach in safeguarding sensitive information.

Emergence of Advanced Analytics Technologies

The identity threat-detection-response market in South America is witnessing a transformation. This transformation is due to the emergence of advanced analytics technologies. These technologies, including machine learning and artificial intelligence, are enhancing the capabilities of identity threat detection and response systems. By leveraging data analytics, organizations can identify patterns and anomalies that may indicate potential threats, thereby improving their response times. In 2025, it is anticipated that the adoption of these technologies will increase by 40%, as businesses seek to stay ahead of evolving cyber threats. This trend suggests a shift towards more proactive security measures, enabling organizations to not only detect threats but also respond effectively. The integration of advanced analytics into identity threat-detection-response solutions is likely to redefine the market landscape, fostering innovation and driving growth.

Growth of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in South America are significantly influencing the identity threat-detection-response market. As businesses increasingly adopt digital technologies, the attack surface for cyber threats expands, necessitating enhanced security measures. In 2025, it is projected that over 70% of organizations in the region will have implemented some form of digital transformation, leading to a corresponding rise in demand for identity protection solutions. This shift not only highlights the importance of securing digital identities but also emphasizes the need for comprehensive threat detection and response capabilities. Consequently, the identity threat-detection-response market is likely to witness substantial growth as organizations strive to protect their digital assets and ensure compliance with evolving security standards.

Need for Enhanced Customer Trust and Loyalty

The identity threat-detection-response market in South America is significantly influenced by the need for enhanced customer trust and loyalty. As consumers become more aware of data privacy issues, businesses are under pressure to demonstrate their commitment to protecting personal information. In 2025, studies indicate that 60% of consumers will prioritize companies that invest in robust identity protection measures. This growing expectation is driving organizations to adopt comprehensive identity threat-detection-response strategies to build trust with their customers. By implementing effective security solutions, businesses can not only mitigate risks but also enhance their brand reputation. This trend highlights the importance of customer-centric security approaches, which are likely to shape the future of the identity threat-detection-response market in the region.