Regulatory Pressures

The identity threat-detection-response market is significantly influenced by regulatory pressures in Canada. Government regulations, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), mandate organizations to implement stringent security measures to protect personal data. Non-compliance can result in hefty fines, which can reach up to $100,000 for organizations. As a result, businesses are compelled to invest in identity threat-detection solutions to ensure compliance and avoid penalties. This regulatory landscape not only drives demand for security solutions but also encourages the development of advanced technologies that align with legal requirements, thereby fostering growth in the identity threat-detection-response market.

Rising Cyber Threats

The identity threat-detection-response market is experiencing growth due to the increasing frequency and sophistication of cyber threats in Canada. Organizations are facing a surge in identity theft, data breaches, and phishing attacks, which necessitate robust security measures. According to recent statistics, cybercrime costs Canadian businesses approximately $3.5 billion annually, highlighting the urgent need for effective identity threat detection and response solutions. As companies strive to protect sensitive information and maintain customer trust, investments in advanced identity threat-detection technologies are likely to rise. This trend indicates a strong demand for innovative solutions that can proactively identify and mitigate potential threats, thereby driving the market forward.

Technological Advancements

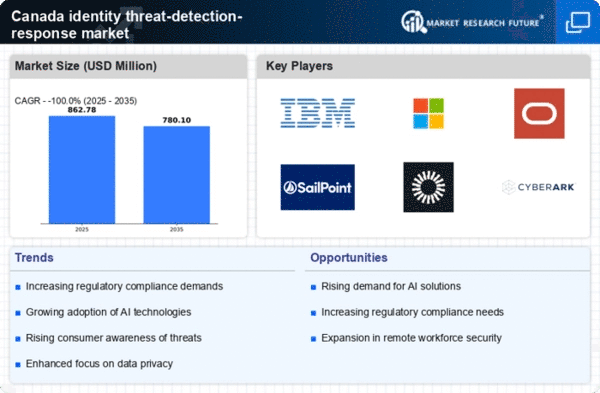

Technological advancements play a crucial role in shaping the identity threat-detection-response market in Canada. Innovations in artificial intelligence (AI), machine learning (ML), and biometrics are enhancing the capabilities of identity threat-detection solutions. These technologies enable organizations to analyze vast amounts of data in real-time, improving threat detection accuracy and response times. The integration of AI and ML into identity security solutions is projected to grow by 25% annually, reflecting the increasing reliance on technology to combat identity-related threats. As organizations seek to leverage these advancements to bolster their security frameworks, the identity threat-detection-response market is poised for substantial growth.

Consumer Awareness and Demand

Consumer awareness regarding data privacy and security is rising in Canada, which is positively impacting the identity threat-detection-response market. As individuals become more informed about the risks associated with identity theft and data breaches, they are increasingly demanding that organizations prioritize their security measures. Surveys indicate that 80% of Canadians are concerned about their personal information being compromised. This heightened awareness compels businesses to adopt advanced identity threat-detection solutions to meet consumer expectations and build trust. As a result, the market is likely to experience growth driven by the need for organizations to enhance their security posture in response to consumer demands.

Increased Digital Transformation

The ongoing digital transformation across various sectors in Canada is a key driver for the identity threat-detection-response market. As organizations increasingly adopt cloud services, mobile applications, and remote work solutions, the attack surface for cyber threats expands. A report indicates that 70% of Canadian businesses have accelerated their digital initiatives, leading to a heightened focus on securing digital identities. This shift necessitates the implementation of comprehensive identity threat-detection and response strategies to safeguard against potential vulnerabilities. Consequently, the market is likely to see a surge in demand for solutions that can effectively address the complexities introduced by digital transformation.