Leading market players are investing heavily in research and development to expand their product lines, which will help the Identity Threat Detection and Response (ITDR) market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Identity Threat Detection and Response (ITDR) industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Identity Threat Detection and Response (ITDR) industry to benefit clients and increase the market sector. In recent years, the Identity Threat Detection and Response (ITDR) industry has offered some of the most significant advantages to the cybersecurity landscape.

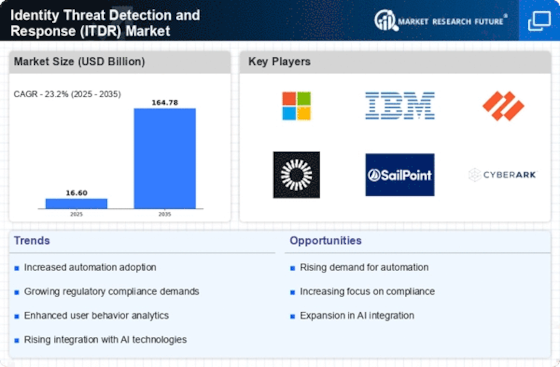

Major players in the Identity Threat Detection and Response (ITDR) Market, including Microsoft (US), IBM (US), CrowdStrike (US), Zscaler (US), Tenable (US), Veronis (US), BeyondTrust (US), CyberArk (US), Proofpoint (US), Quest (US) are attempting to increase market demand by investing in research and development operations.

International Business Machines Corp (IBM) is a global provider of hybrid cloud, AI, and consulting solutions. The company develops system hardware and software, offering infrastructure, hosting, and consulting services. IBM focuses on analytics, artificial intelligence, automation, blockchain, cloud computing, IT infrastructure, cybersecurity, and software development. Additionally, it provides cloud, networking, security, technology consulting, application services, business resilience services, and technology support across industries such as automotive, banking, electronics, energy, healthcare, insurance, manufacturing, retail, travel, and telecom. Headquartered in Armonk, New York, USA, IBM operates worldwide across the Americas, Europe, Middle East, Africa, and Asia-Pacific.

In January 2024, IBM partnered with ASUS to bolster cybersecurity using AI-driven technologies for rapid attack detection and response. IBM's QRadar EDR will integrate directly into ASUS's business hardware, complemented by IBM's managed detection and response (MDR) services.

CyberArk Software Ltd (CyberArk) specializes in providing information technology (IT) security solutions, focusing primarily on privileged access security (PAS), secret management, and access management solutions. These solutions safeguard organizations from cyber threats originating from both external and internal sources, enabling real-time detection and mitigation of security risks. CyberArk serves a wide range of enterprises across diverse industries, including energy, financial services, healthcare, manufacturing, retail, technology, telecommunications, and government agencies. The company operates globally with offices in the UK, Germany, the US, Israel, the Netherlands, France, Italy, Australia, and Singapore, with headquarters in Petach-Tikva, Israel.

In September 2023, CyberArk collaborated with Accenture to deploy CyberArk Privilege Cloud, enhancing Privileged Access Management (PAM) solutions. This strategic initiative aims to strengthen cybersecurity defenses by effectively managing and monitoring privileged access, a critical component of Identity Threat Detection and Response (ITDR). Leveraging CyberArk's Identity Security Platform, the collaboration ensures comprehensive security for identities across diverse IT environments, aligning with ITDR principles to secure access and mitigate risks associated with privileged accounts.