Rising Awareness of Blood Disorders

There is a notable increase in public awareness regarding blood disorders in South America, which is driving the hematology diagnostics market. Educational campaigns and health initiatives are informing the population about the symptoms and risks associated with various hematological conditions. This heightened awareness is leading to more individuals seeking diagnostic testing, thereby increasing demand for hematology diagnostics. Recent surveys indicate that approximately 60% of the population is now more informed about blood health than five years ago. As awareness continues to grow, the hematology diagnostics market is expected to expand, as healthcare providers respond to the increasing demand for testing and early intervention.

Investment in Healthcare Infrastructure

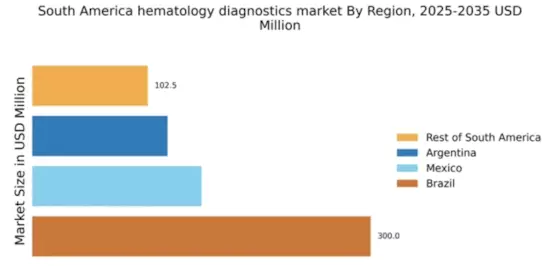

The enhancement of healthcare infrastructure across South America is significantly impacting the hematology diagnostics market. Governments and private entities are increasingly allocating funds to improve laboratory facilities and diagnostic capabilities. For instance, recent investments have reached over $500 million in the last two years, aimed at modernizing healthcare facilities. This influx of capital is facilitating the acquisition of advanced hematology diagnostic equipment and technologies. Improved infrastructure not only increases the availability of diagnostic services but also enhances the quality of care provided to patients. Consequently, the hematology diagnostics market is poised for growth as more facilities become equipped to handle complex diagnostic needs.

Growing Prevalence of Hematological Disorders

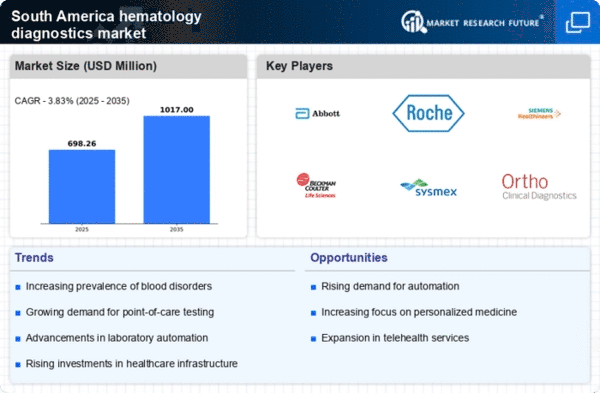

The rising incidence of hematological disorders in South America is a primary driver for the hematology diagnostics market. Conditions such as anemia, leukemia, and thrombocytopenia are becoming increasingly common, necessitating advanced diagnostic solutions. According to recent health statistics, approximately 15% of the population in certain South American countries is affected by some form of blood disorder. This growing prevalence is prompting healthcare providers to invest in sophisticated diagnostic tools, thereby expanding the hematology diagnostics market. The increasing awareness of these conditions among the population is also contributing to the demand for early diagnosis and treatment, which is crucial for improving patient outcomes. As a result, the hematology diagnostics market is likely to experience significant growth in response to these trends.

Technological Innovations in Diagnostic Tools

Technological advancements in diagnostic tools are revolutionizing the hematology diagnostics market in South America. Innovations such as automated analyzers and advanced imaging techniques are enhancing the accuracy and efficiency of blood tests. The introduction of these technologies is reducing the turnaround time for results, which is critical for timely patient management. Market data suggests that the adoption of automated systems has increased by over 30% in the last year alone. As healthcare facilities strive to improve diagnostic capabilities, the demand for cutting-edge hematology diagnostic tools is likely to rise, further propelling market growth.

Regulatory Support for Diagnostic Advancements

Regulatory bodies in South America are increasingly supporting advancements in the hematology diagnostics market. New policies and guidelines are being established to facilitate the approval and integration of innovative diagnostic technologies. This regulatory support is crucial for ensuring that healthcare providers have access to the latest diagnostic tools, which can improve patient outcomes. Recent changes in regulations have expedited the approval process for new hematology diagnostic devices, allowing for quicker market entry. As a result, the hematology diagnostics market is expected to benefit from this supportive regulatory environment, fostering innovation and enhancing the overall quality of diagnostic services.