Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in the UK, which is influencing the hematology diagnostics market. As awareness of the importance of early detection and prevention of diseases increases, more individuals are seeking regular blood tests and screenings. This trend is supported by public health campaigns aimed at educating the population about the benefits of early diagnosis. Consequently, the demand for hematology diagnostic services is expected to rise, as healthcare providers respond to this shift in patient behavior. The hematology diagnostics market is likely to expand as more resources are allocated to preventive measures, ultimately leading to better health outcomes for the population.

Increased Healthcare Expenditure

The UK government has been progressively increasing its healthcare expenditure, which significantly impacts the hematology diagnostics market. With a focus on improving patient outcomes and enhancing diagnostic capabilities, funding for advanced diagnostic tools and technologies is on the rise. In 2025, the NHS budget is projected to exceed £200 billion, with a substantial portion allocated to diagnostic services. This financial commitment is likely to facilitate the adoption of cutting-edge hematology diagnostic solutions, thereby driving market growth. Enhanced funding not only supports the procurement of advanced equipment but also promotes research and development in the hematology diagnostics market.

Growing Demand for Point-of-Care Testing

The shift towards point-of-care testing (POCT) is reshaping the landscape of the hematology diagnostics market. Patients and healthcare providers are increasingly seeking rapid and accurate diagnostic solutions that can be administered outside traditional laboratory settings. POCT offers the advantage of immediate results, which is crucial for timely clinical decision-making. The UK market is witnessing a surge in the adoption of portable hematology analyzers, which are expected to capture a significant share of the market. By 2026, the POCT segment within the hematology diagnostics market could account for over 30% of total market revenue, reflecting the growing preference for decentralized testing.

Rising Prevalence of Hematological Disorders

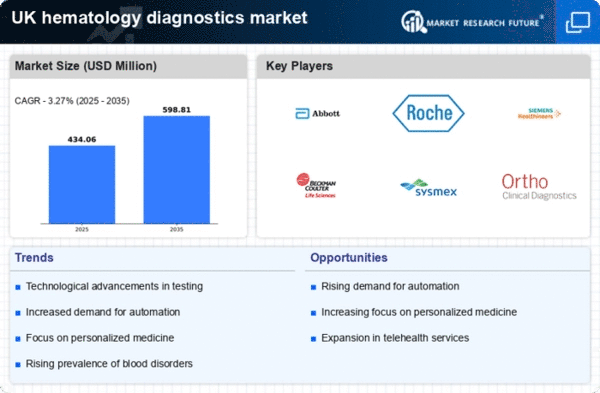

The increasing incidence of hematological disorders in the UK is a primary driver for the hematology diagnostics market. Conditions such as anemia, leukemia, and lymphoma are becoming more prevalent, necessitating advanced diagnostic solutions. According to recent data, approximately 1 in 3 individuals in the UK may experience some form of blood disorder during their lifetime. This rising prevalence is prompting healthcare providers to invest in innovative diagnostic technologies, thereby expanding the market. The hematology diagnostics market is expected to witness a compound annual growth rate (CAGR) of around 6% over the next few years, driven by the need for accurate and timely diagnosis of these conditions.

Technological Integration in Healthcare Systems

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into healthcare systems is driving innovation in the hematology diagnostics market. These technologies enhance the accuracy and efficiency of diagnostic processes, enabling healthcare professionals to make more informed decisions. In the UK, hospitals are increasingly adopting AI-driven diagnostic tools, which can analyze vast amounts of data and provide insights that were previously unattainable. This trend is likely to lead to improved patient outcomes and increased operational efficiency within healthcare facilities. The hematology diagnostics market stands to benefit significantly from this technological evolution, as it aligns with the broader movement towards digital health solutions.