Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is significantly influencing the hematology diagnostics market. As healthcare systems shift towards proactive disease management, early detection of hematological conditions becomes paramount. This trend is reflected in the rising demand for routine blood tests and screenings, which facilitate early diagnosis and intervention. The hematology diagnostics market is benefiting from this shift, as healthcare providers prioritize comprehensive blood analysis to identify potential health issues before they escalate. Moreover, public health initiatives aimed at raising awareness about blood disorders further drive the demand for diagnostic services. Consequently, the market is expected to expand as more individuals seek preventive testing and healthcare providers enhance their diagnostic capabilities.

Growing Demand for Home Healthcare Solutions

The increasing demand for home healthcare solutions is reshaping the hematology diagnostics market. Patients are increasingly seeking convenient and accessible diagnostic options that can be performed in the comfort of their homes. This trend is driven by a desire for greater autonomy in managing health conditions, particularly among chronic disease patients. The market is witnessing the emergence of portable diagnostic devices and home testing kits that enable individuals to monitor their hematological health without frequent hospital visits. This shift towards home-based care is likely to enhance patient engagement and adherence to treatment plans. Consequently, the hematology diagnostics market is expected to expand as it adapts to the growing preference for home healthcare solutions.

Rising Prevalence of Hematological Disorders

The increasing incidence of hematological disorders, such as anemia, leukemia, and lymphoma, is a primary driver for the hematology diagnostics market. According to recent data, approximately 3 million individuals in the US are diagnosed with anemia annually, highlighting a significant need for effective diagnostic solutions. This growing patient population necessitates advanced diagnostic tools to ensure timely and accurate disease management. As healthcare providers seek to improve patient outcomes, the demand for innovative hematology diagnostics is expected to rise. Furthermore, the aging population, which is more susceptible to these disorders, contributes to the market's expansion. The hematology diagnostics market is thus poised for growth as it adapts to the increasing healthcare demands associated with these conditions.

Regulatory Support for Diagnostic Innovations

Regulatory bodies in the US are increasingly supporting innovations in the hematology diagnostics market, which is fostering growth in the industry. Initiatives aimed at streamlining the approval process for new diagnostic tests and technologies are encouraging manufacturers to invest in research and development. The Food and Drug Administration (FDA) has introduced programs to expedite the review of breakthrough devices, which can significantly enhance diagnostic accuracy and patient care. This regulatory support is likely to lead to a surge in the introduction of novel diagnostic solutions, thereby expanding the hematology diagnostics market. As a result, stakeholders in the industry are expected to benefit from a more favorable environment for innovation and commercialization.

Technological Innovations in Diagnostic Tools

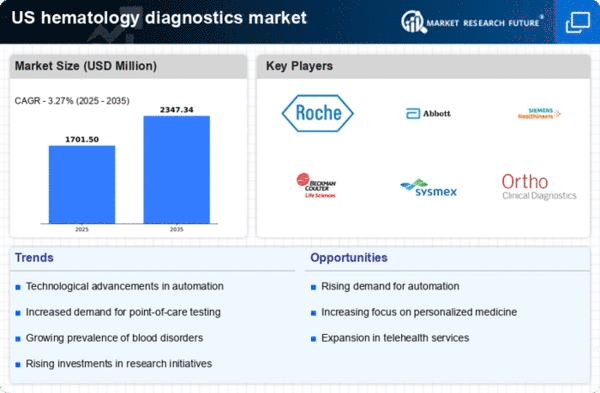

Technological advancements in diagnostic tools are transforming the hematology diagnostics market. Innovations such as automated analyzers, point-of-care testing devices, and advanced imaging techniques enhance the accuracy and efficiency of hematological assessments. For instance, the introduction of next-generation sequencing (NGS) has revolutionized the detection of genetic mutations in blood disorders, allowing for more precise diagnoses. The market is projected to witness a compound annual growth rate (CAGR) of around 7% over the next five years, driven by these technological improvements. As laboratories and healthcare facilities increasingly adopt these cutting-edge technologies, the hematology diagnostics market is likely to experience substantial growth, catering to the evolving needs of healthcare providers and patients alike.