Growth in Smart City Initiatives

The graph database market in South America is positively impacted by the growth of smart city initiatives. As urban areas strive to become more efficient and sustainable, the need for advanced data management solutions becomes critical. Graph databases facilitate the integration of various data sources, enabling city planners to analyze transportation, energy consumption, and public safety data effectively. With investments in smart city projects projected to reach $1 trillion by 2025, the demand for graph databases is expected to rise significantly. This trend suggests that the graph database market will play a vital role in supporting the infrastructure of future urban environments.

Expansion of Social Media Analytics

The graph database market in South America is significantly influenced by the expansion of social media analytics. Companies are leveraging graph databases to analyze user interactions and relationships on social platforms, enabling them to derive actionable insights. This trend is particularly relevant as social media usage continues to rise, with over 60% of the population actively engaging on various platforms. By utilizing graph databases, businesses can better understand customer behavior and preferences, leading to more targeted marketing strategies. This growing need for sophisticated analytics tools is likely to propel the graph database market forward, as organizations seek to harness the power of social data.

Increased Focus on Cybersecurity Solutions

The graph database market in South America is witnessing a heightened focus on cybersecurity solutions. As cyber threats become more sophisticated, organizations are turning to graph databases to enhance their security measures. These databases allow for the mapping of complex relationships between entities, which is crucial for identifying potential vulnerabilities and threats. The cybersecurity market in the region is expected to grow by approximately 20% annually, indicating a strong demand for advanced security solutions. Consequently, the integration of graph databases into cybersecurity frameworks is likely to drive growth in the graph database market, as businesses prioritize data protection.

Rising Demand for Real-Time Data Processing

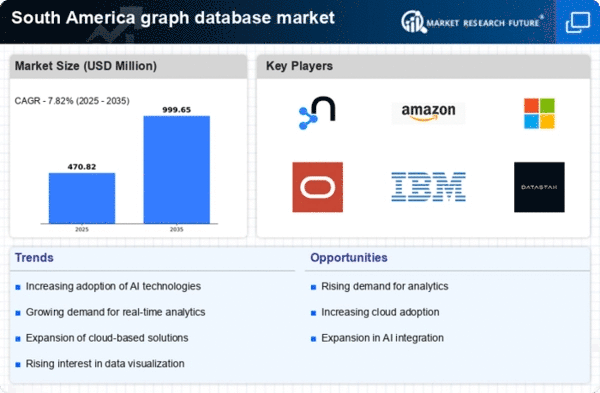

The graph database market in South America experiences a notable surge in demand for real-time data processing capabilities. As businesses increasingly rely on immediate insights for decision-making, the ability to analyze complex relationships in data becomes paramount. This trend is particularly evident in sectors such as telecommunications and logistics, where timely data can enhance operational efficiency. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. Consequently, organizations are investing in graph databases to facilitate faster data retrieval and analysis, thereby driving growth in the graph database market.

Adoption of AI and Machine Learning Technologies

The graph database market in South America is increasingly influenced by the adoption of AI and machine learning technologies. Organizations are recognizing the potential of graph databases to enhance machine learning algorithms by providing a more intuitive representation of data relationships. This capability is particularly valuable in sectors such as healthcare and finance, where understanding complex data interactions is essential. The AI market in the region is anticipated to grow at a CAGR of around 30% over the next few years, indicating a robust demand for technologies that can support AI initiatives. As a result, the integration of graph databases into AI frameworks is likely to drive further growth in the graph database market.