Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions significantly influences the graph database market in Japan. As organizations increasingly migrate their operations to the cloud, the demand for scalable and flexible database solutions rises. Graph databases, known for their ability to handle complex queries and relationships, are particularly well-suited for cloud environments. This transition allows businesses to reduce infrastructure costs while enhancing accessibility and collaboration. Recent data indicates that cloud adoption in Japan is expected to reach 40% by 2026, further driving the need for graph database solutions that can seamlessly integrate with cloud platforms. Consequently, the expansion of cloud-based solutions is likely to play a pivotal role in shaping the future landscape of the graph database market in Japan.

Emergence of Smart City Initiatives

The development of smart city initiatives in Japan significantly impacts the graph database market. As urban areas strive to become more efficient and sustainable, the need for advanced data management solutions becomes paramount. Graph databases facilitate the integration and analysis of diverse data sources, enabling city planners and administrators to make informed decisions regarding infrastructure, transportation, and public services. The Japanese government has allocated substantial funding towards smart city projects, with investments expected to reach ¥1 trillion by 2027. This financial commitment underscores the potential for graph databases to play a crucial role in the realization of smart city objectives, thereby driving growth in the graph database market.

Growing Importance of Cybersecurity

In an era where data breaches and cyber threats are increasingly prevalent, the graph database market in Japan witnessed a heightened focus on cybersecurity. Organizations are recognizing the necessity of implementing robust security measures to protect sensitive information. Graph databases offer unique advantages in this regard, as they can effectively model and analyze complex relationships between entities, aiding in the identification of potential vulnerabilities and threats. As businesses invest more in cybersecurity solutions, the graph database market is expected to benefit from this trend. Recent statistics suggest that cybersecurity spending in Japan is projected to exceed $10 billion by 2025, indicating a strong correlation between the growth of cybersecurity initiatives and the adoption of graph database technologies.

Increased Focus on Customer Experience

The graph database market in Japan is increasingly influenced by the growing emphasis on enhancing customer experience. Businesses across various sectors are recognizing that understanding customer behavior and preferences is vital for maintaining competitiveness. Graph databases enable organizations to analyze complex customer interactions and relationships, providing valuable insights that can inform marketing strategies and product development. Recent surveys indicate that companies prioritizing customer experience are likely to see a 20% increase in customer retention rates. As organizations invest in technologies that facilitate a deeper understanding of their customers, the graph database market is poised for growth, driven by the need for solutions that support personalized and data-driven customer engagement.

Rising Demand for Data-Driven Insights

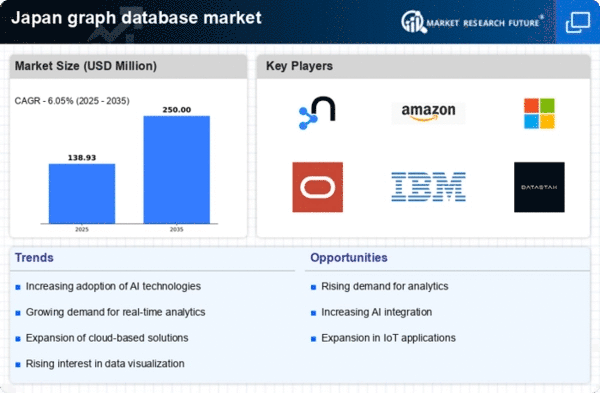

the graph database market in Japan experienced a notable surge in demand for data-driven insights across various sectors. Organizations are increasingly recognizing the value of leveraging complex data relationships to enhance decision-making processes. This trend is particularly evident in industries such as finance and telecommunications, where the ability to analyze interconnected data can lead to improved customer experiences and operational efficiencies. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years, driven by the need for advanced analytics and real-time data processing capabilities. As businesses strive to remain competitive, the adoption of graph databases becomes essential for unlocking valuable insights from vast datasets, thereby propelling the growth of the graph database market in Japan.