Expansion of IoT Applications

The proliferation of Internet of Things (IoT) devices is driving substantial growth in the graph database market. As more devices become interconnected, the volume of data generated increases exponentially, necessitating advanced data management solutions. Graph databases are particularly well-suited for handling the intricate relationships between IoT devices, enabling organisations to derive meaningful insights from the data. In the UK, the IoT market is expected to reach £50 billion by 2025, which could lead to a corresponding increase in the need for graph databases to manage the complex data structures associated with IoT applications. This expansion presents a significant opportunity for the graph database market, as businesses seek to leverage the capabilities of graph technology to optimise their IoT strategies and enhance operational efficiency.

Growth in Social Network Analysis

The graph database market is witnessing a marked increase in applications related to social network analysis. As organisations strive to understand customer interactions and relationships, the need for sophisticated data models that can represent these connections becomes paramount. Graph databases excel in this area, allowing for the exploration of complex social networks and the identification of key influencers. Recent studies indicate that the social media analytics market is projected to grow by 25% annually, which is likely to drive further investment in graph database technologies. This growth reflects a broader trend within the graph database market, where businesses are increasingly leveraging these tools to enhance their marketing strategies and improve customer engagement through targeted campaigns.

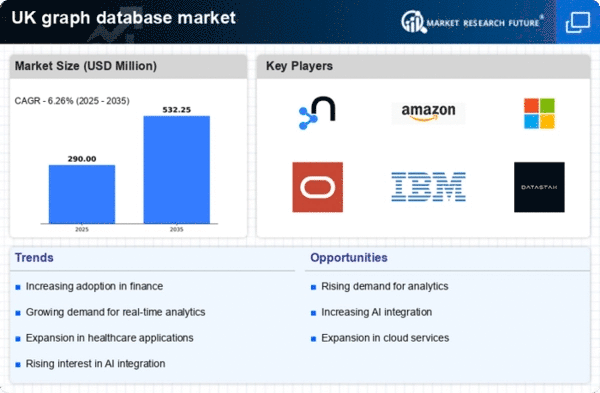

Rising Demand for Real-Time Analytics

The graph database market is experiencing a notable surge in demand for real-time analytics capabilities. Businesses across various sectors are increasingly recognising the value of immediate data insights, which can drive timely decision-making. This trend is particularly pronounced in industries such as retail and telecommunications, where customer behaviour and network performance must be monitored continuously. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 30% over the next five years. This growth is likely to propel the adoption of graph databases, as they are inherently designed to handle complex queries and relationships efficiently, thus enhancing the overall analytical capabilities of organisations. As a result, the graph database market is poised to benefit significantly from this rising demand for real-time data processing and analysis.

Emergence of Advanced Fraud Detection Techniques

The graph database market is increasingly being influenced by the emergence of advanced fraud detection techniques. Financial institutions and e-commerce platforms are adopting graph databases to combat fraud more effectively by analysing complex relationships and patterns within transaction data. This approach allows for the identification of suspicious activities that may not be apparent through traditional data analysis methods. In the UK, the financial services sector was projected to allocate approximately £1 billion towards fraud prevention technologies by 2026., which could significantly bolster the graph database market. As organisations seek to enhance their fraud detection capabilities, the demand for graph databases is likely to rise, positioning them as a critical component in the fight against financial crime.

Increased Focus on Personalised Customer Experiences

The graph database market is benefiting from an increased focus on delivering personalised customer experiences. Businesses are recognising that understanding customer preferences and behaviours is essential for driving engagement and loyalty. Graph databases facilitate this by enabling organisations to analyse customer data in a relational context, thus uncovering insights that can inform tailored marketing strategies. In the UK, the market for personalised marketing solutions is expected to grow by 20% over the next few years, which may lead to a heightened demand for graph databases as companies seek to leverage their capabilities for customer segmentation and targeted outreach. This trend underscores the potential of graph databases to enhance customer relationship management and drive business growth.