Advancements in Genetic Research

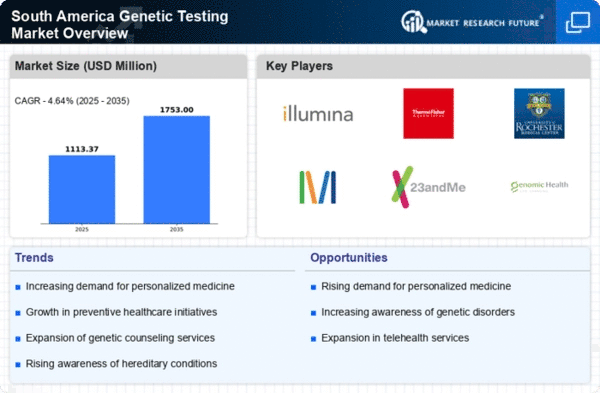

the genetic testing market in South America is propelled by significant advancements in genetic research. Innovations in genomics and biotechnology are leading to the development of more accurate and efficient testing methods. These advancements not only enhance the reliability of genetic tests but also reduce costs, making them more accessible to a broader population. As research continues to evolve, the market is expected to witness a transformation, with new testing modalities emerging. This could potentially increase the market size to around $1.8 billion by 2028, as more individuals seek genetic testing for various applications, including ancestry, health risks, and carrier status.

Increased Investment in Biotechnology

The genetic testing market in South America is experiencing a boost due to increased investment in biotechnology. Governments and private investors are recognizing the potential of biotechnology to drive economic growth and improve public health outcomes. This influx of capital is facilitating the development of innovative genetic testing solutions and expanding the capabilities of existing laboratories. As a result, the market is likely to see a rise in the availability of advanced genetic tests, which could enhance diagnostic accuracy and patient outcomes. Projections indicate that the market may reach approximately $1.4 billion by 2027, reflecting the positive impact of these investments on the genetic testing landscape.

Expansion of Healthcare Infrastructure

the genetic testing market in South America benefits from the ongoing expansion of healthcare infrastructure across the region. Governments and private entities are investing in modernizing healthcare facilities, which includes the integration of advanced diagnostic technologies. This expansion is crucial for improving access to genetic testing services, particularly in rural and underserved areas. Enhanced infrastructure not only facilitates the availability of genetic testing but also promotes awareness and education about its benefits. As a result, the market is expected to grow, with projections indicating a potential increase in market value to $1.2 billion by 2026. This development is likely to create a more robust environment for genetic testing services.

Growing Prevalence of Genetic Disorders

The rising prevalence of genetic disorders in South America is a significant driver for the genetic testing market. Conditions such as cystic fibrosis, sickle cell anemia, and various hereditary cancers are becoming increasingly common, prompting a greater need for genetic testing. This trend is further supported by the increasing awareness among healthcare professionals regarding the importance of early diagnosis and intervention. As a result, the market is anticipated to expand, with estimates suggesting a growth rate of approximately 8% annually. The genetic testing market is likely to play a pivotal role in identifying at-risk individuals and providing them with necessary preventive measures and treatment options.

Rising Demand for Personalized Medicine

the genetic testing market in South America is experiencing a surge in demand for personalized medicine. This trend is driven by an increasing recognition of the importance of tailored healthcare solutions that cater to individual genetic profiles. As healthcare providers and patients alike seek more effective treatment options, the market for genetic testing is projected to grow significantly. According to recent estimates, the market could reach approximately $1.5 billion by 2027, reflecting a compound annual growth rate (CAGR) of around 10%. This shift towards personalized medicine is likely to enhance the role of genetic testing in disease prevention and management, thereby solidifying its position within the healthcare landscape.