Rising Infertility Rates

The increasing prevalence of infertility is a notable driver for the Preimplantation Genetic Testing Market. Factors such as delayed childbearing, lifestyle changes, and environmental influences contribute to this trend. According to recent statistics, infertility affects approximately 10-15% of couples worldwide, leading to a heightened demand for assisted reproductive technologies. Preimplantation genetic testing offers a solution by enabling the selection of genetically healthy embryos, thereby improving the chances of successful pregnancies. As more individuals and couples seek fertility treatments, the market for preimplantation genetic testing is likely to expand, reflecting the urgent need for effective reproductive solutions.

Technological Innovations

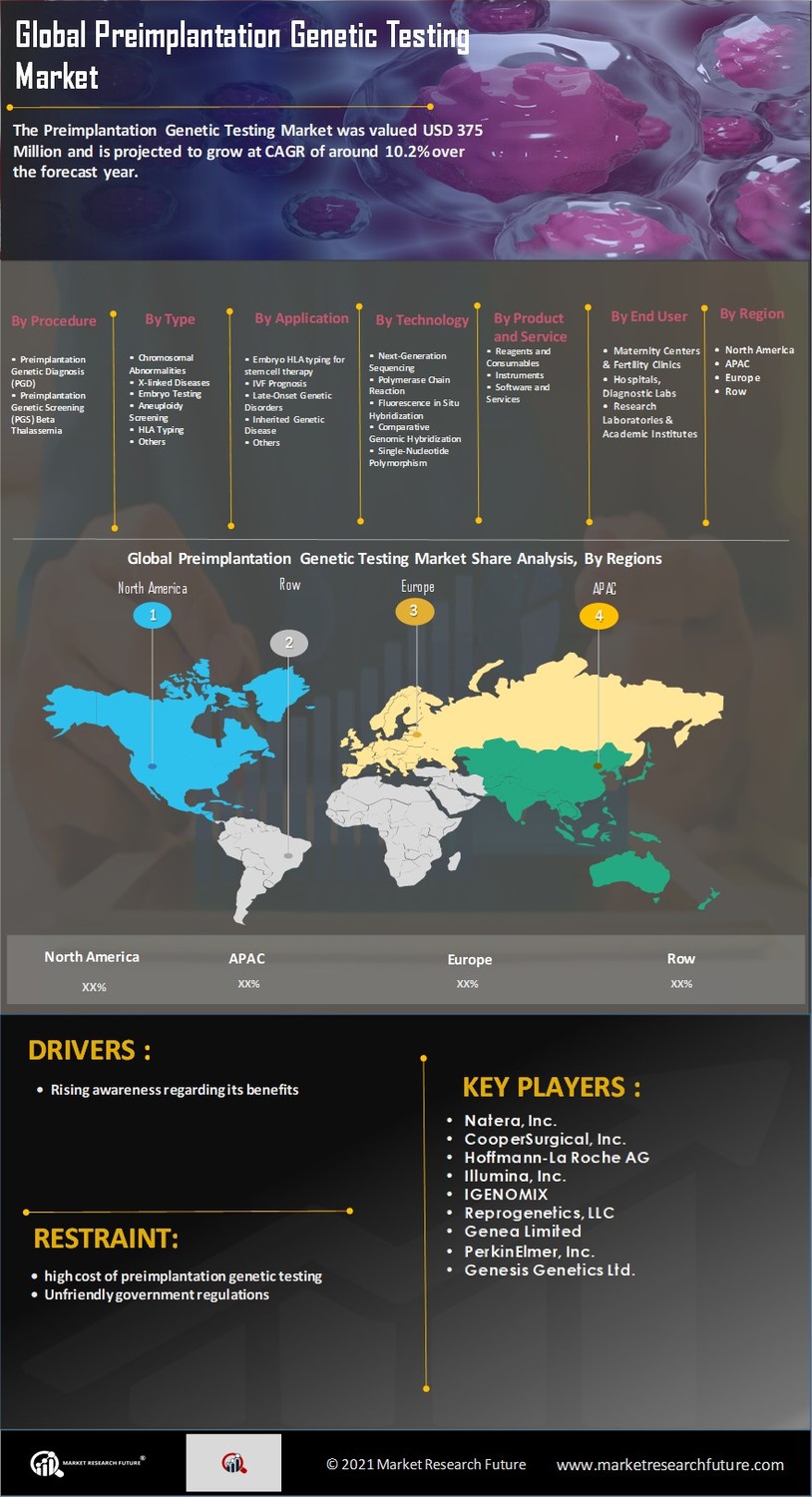

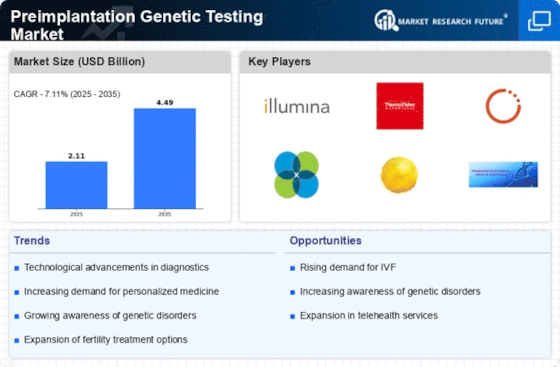

Technological advancements in genetic testing methodologies are propelling the Preimplantation Genetic Testing Market forward. Innovations such as next-generation sequencing (NGS) and improved bioinformatics tools enhance the accuracy and efficiency of genetic testing. These technologies allow for comprehensive analysis of embryos, identifying genetic abnormalities with greater precision. The market has witnessed a surge in the adoption of these advanced techniques, which not only improve diagnostic capabilities but also reduce the time required for testing. As the technology continues to evolve, it is expected that the Preimplantation Genetic Testing Market will experience significant growth, driven by the demand for more reliable and faster testing solutions.

Increased Public Awareness

Growing public awareness regarding genetic disorders and the benefits of preimplantation genetic testing is a crucial driver for the Preimplantation Genetic Testing Market. Educational campaigns and media coverage have played a pivotal role in informing potential parents about the advantages of genetic testing in preventing hereditary diseases. As individuals become more knowledgeable about the implications of genetic conditions, the demand for preimplantation genetic testing is likely to rise. This heightened awareness not only encourages couples to consider genetic testing as part of their reproductive planning but also fosters a more informed dialogue about reproductive health, thereby expanding the market.

Regulatory Support and Guidelines

The establishment of supportive regulatory frameworks is influencing the Preimplantation Genetic Testing Market positively. Governments and health organizations are increasingly recognizing the importance of genetic testing in reproductive health. Guidelines that promote the safe and ethical use of preimplantation genetic testing are being developed, which may enhance public trust and acceptance. Furthermore, regulatory approvals for new testing technologies can facilitate market entry for innovative solutions. As these frameworks evolve, they are likely to create a more conducive environment for the growth of the preimplantation genetic testing market, encouraging investment and research in this field.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is significantly impacting the Preimplantation Genetic Testing Market. As healthcare moves towards tailored treatment plans based on individual genetic profiles, preimplantation genetic testing aligns perfectly with this trend. Couples are increasingly seeking personalized approaches to family planning, which includes selecting embryos based on genetic compatibility and health. This demand for customized reproductive solutions is expected to drive market growth, as preimplantation genetic testing provides essential information that aids in making informed decisions. The integration of personalized medicine principles into reproductive health is likely to enhance the appeal and adoption of preimplantation genetic testing.