Technological Advancements in RFID Systems

Technological advancements in RFID systems are significantly impacting the data center-rfid market in South America. Innovations such as improved read ranges, enhanced data storage capabilities, and integration with artificial intelligence are making RFID solutions more attractive to businesses. These advancements are expected to reduce costs and improve the efficiency of RFID systems, making them more accessible to a wider range of industries. As companies look to leverage these technologies, the market for RFID solutions is projected to grow by 12% annually. This trend indicates a strong potential for the data center-rfid market to thrive as organizations adopt cutting-edge technologies to enhance their operations.

Increased Focus on Supply Chain Optimization

The data center RFID market in South America is benefiting from an increased focus on supply chain optimization. Companies are recognizing the importance of efficient supply chain management in maintaining competitiveness and profitability. RFID technology offers a solution for tracking goods throughout the supply chain, providing real-time data that can lead to better decision-making. As businesses strive to reduce lead times and improve inventory turnover, the demand for RFID solutions is expected to rise. The market for supply chain RFID applications is projected to grow by 18% in the next few years, indicating a robust opportunity for the data center-rfid market to capitalize on this trend.

Rise of E-commerce and Digital Transformation

The rapid rise of e-commerce in South America is driving the data center RFID market. Businesses are seeking to streamline their operations. With the increasing volume of online transactions, companies are turning to RFID technology to manage their inventory and logistics more effectively. The e-commerce sector is expected to grow by 20% in the coming years, necessitating advanced tracking solutions to handle the surge in demand. RFID systems enable real-time visibility of products, which is crucial for meeting customer expectations in a fast-paced digital environment. Consequently, the data center-rfid market is likely to expand as businesses adapt to the evolving landscape of e-commerce.

Regulatory Compliance and Security Enhancements

In South America, regulatory compliance is becoming increasingly stringent, particularly in sectors such as finance and healthcare. The data center RFID market is poised to grow as organizations seek to comply with these regulations while enhancing security measures. RFID technology provides a robust solution for tracking sensitive assets and ensuring that they are handled according to legal requirements. The market for RFID security solutions is projected to grow by 15% annually, reflecting the increasing importance of compliance in business operations. As companies invest in technologies that ensure adherence to regulations, the data center-rfid market is likely to see a corresponding increase in demand.

Growing Demand for Efficient Inventory Management

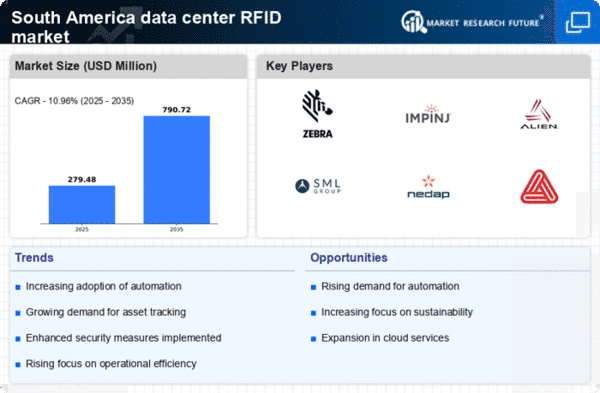

The data center RFID market in South America is experiencing a surge in demand for efficient inventory management solutions. Companies are increasingly recognizing the need for real-time tracking of assets to enhance operational efficiency. The integration of RFID technology allows for automated inventory processes, reducing human error and improving accuracy. In 2025, it is estimated that the market for RFID solutions in inventory management could reach $500 million in South America. This growth is driven by the need for businesses to optimize their supply chains and reduce costs, thereby enhancing their competitive edge in the market. As organizations strive for operational excellence, the data center-rfid market is likely to benefit significantly from this trend.