Cost Reduction Initiatives

Cost reduction remains a critical focus for data centers across Europe, driving the adoption of RFID technology. The data center-rfid market is benefiting from organizations seeking to lower operational costs through improved inventory management and asset tracking. RFID systems enable data centers to reduce labor costs associated with manual tracking and inventory audits, leading to significant savings. It is estimated that implementing RFID can reduce inventory management costs by up to 30%. As data centers strive to enhance their bottom line, the demand for cost-effective RFID solutions is likely to increase, further propelling market growth in the coming years.

Enhanced Supply Chain Visibility

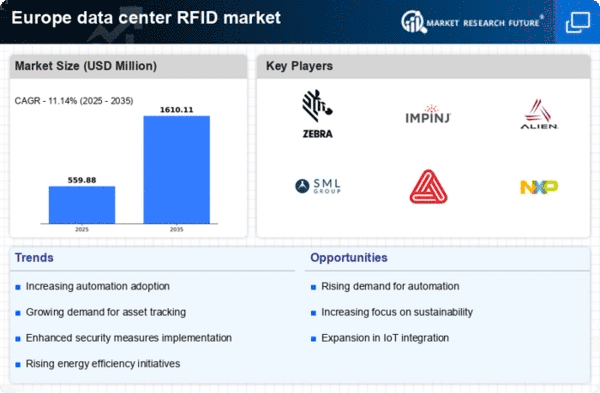

Enhanced supply chain visibility is becoming increasingly vital for data centers in Europe, thereby influencing the data center-rfid market. As organizations strive for greater transparency and efficiency in their supply chains, RFID technology offers a solution by providing real-time tracking of assets and inventory. This visibility allows data centers to respond swiftly to changes in demand and optimize their supply chain operations. The European data center-rfid market is projected to grow as companies recognize the value of RFID in achieving supply chain excellence. With an expected market growth rate of 12% annually, the integration of RFID into supply chain processes is likely to become a standard practice in the industry.

Integration with IoT Technologies

The integration of RFID technology with Internet of Things (IoT) systems is emerging as a pivotal driver for the data center-rfid market in Europe. This convergence allows for enhanced data collection and analysis, enabling data centers to optimize their operations. By leveraging IoT capabilities, RFID systems can provide insights into asset utilization, environmental conditions, and operational efficiency. The European market is witnessing a shift towards smart data centers, where RFID plays a crucial role in facilitating seamless communication between devices. This trend is expected to propel the market growth, with projections indicating a potential increase in market size by 20% over the next few years as more data centers adopt IoT-integrated RFID solutions.

Regulatory Compliance and Standards

The data center-rfid market in Europe is significantly influenced by stringent regulatory compliance and standards. As data protection laws, such as the General Data Protection Regulation (GDPR), become more prevalent, data centers are compelled to adopt RFID solutions that ensure compliance with these regulations. RFID technology aids in maintaining accurate records of asset movements and access, thereby enhancing accountability and traceability. The European market is expected to see an increase in investments in RFID systems that align with these regulatory requirements, potentially reaching €1 billion by 2026. This focus on compliance not only mitigates risks but also fosters trust among clients and stakeholders.

Growing Demand for Real-Time Asset Tracking

The data center-rfid market in Europe is experiencing a notable surge in demand for real-time asset tracking solutions. This trend is driven by the increasing need for operational efficiency and inventory management within data centers. Companies are seeking to minimize downtime and enhance productivity, which RFID technology facilitates by providing accurate, real-time data on asset locations. According to recent estimates, the market for RFID solutions in data centers is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the industry's shift towards more automated and efficient asset management practices, which are essential for maintaining competitive advantage in a rapidly evolving technological landscape.