Aging Population

The demographic shift towards an aging population in South America is influencing the continuous glucose-monitoring-system market. Older adults are at a higher risk for developing diabetes, and as the population ages, the demand for effective monitoring solutions is likely to rise. Current projections indicate that by 2030, the number of individuals aged 65 and older in South America will increase significantly, leading to a greater need for diabetes management tools. The continuous glucose-monitoring-system market must adapt to cater to this demographic, focusing on ease of use and accessibility. This trend suggests that manufacturers may need to prioritize features that accommodate the specific needs of older users, thereby enhancing market potential.

Increasing Health Awareness

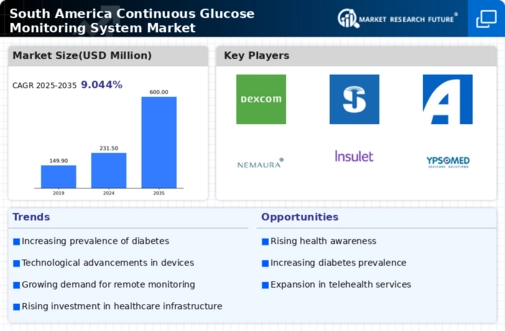

The rising health consciousness among the South American population appears to be a pivotal driver for the continuous glucose-monitoring-system market. As individuals become more informed about diabetes management and the importance of maintaining optimal glucose levels, the demand for advanced monitoring solutions is likely to increase. This trend is reflected in the growing number of diabetes education programs and health campaigns across the region. Furthermore, the continuous glucose-monitoring-system market is expected to benefit from the increasing emphasis on preventive healthcare, which encourages individuals to adopt proactive measures in managing their health. The market could see a surge in adoption rates, particularly among younger demographics who are more inclined to utilize technology for health monitoring.

Rising Incidence of Obesity

The escalating rates of obesity in South America are contributing significantly to the continuous glucose-monitoring-system market. Obesity is a well-known risk factor for type 2 diabetes, and as the prevalence of obesity rises, so does the potential for diabetes cases. According to recent statistics, approximately 25% of adults in South America are classified as obese, which correlates with an increased demand for effective diabetes management solutions. The continuous glucose-monitoring-system market is likely to experience growth as healthcare providers and patients seek reliable tools to monitor glucose levels and manage weight effectively. This trend suggests a potential for innovative solutions that cater to the unique needs of obese individuals, thereby expanding the market further.

Healthcare Infrastructure Development

The ongoing development of healthcare infrastructure in South America is a crucial driver for the continuous glucose-monitoring-system market. As governments and private sectors invest in healthcare facilities and services, access to diabetes care is improving. Enhanced infrastructure facilitates the distribution and availability of continuous glucose-monitoring systems, making them more accessible to patients. The continuous glucose-monitoring-system market is likely to benefit from these improvements, as increased access to healthcare services correlates with higher adoption rates of monitoring technologies. This trend indicates a positive outlook for the market, as better healthcare infrastructure supports the integration of advanced diabetes management solutions.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare systems in South America is driving the continuous glucose-monitoring-system market. Innovations such as mobile health applications, telemedicine, and data analytics are enhancing the way diabetes is managed. The continuous glucose-monitoring-system market is witnessing a shift towards more connected devices that allow for real-time monitoring and data sharing between patients and healthcare providers. This technological evolution not only improves patient outcomes but also fosters a more collaborative approach to diabetes management. As healthcare systems increasingly adopt these technologies, the market is poised for growth, with a focus on user-friendly interfaces and seamless connectivity.