Emergence of Local Content Creators

the emergence of local content creators is shaping content strategies in the content intelligence market in South America. As regional businesses seek to connect with local audiences, the demand for culturally relevant content increases. This trend is expected to contribute to a 20% growth in the content intelligence market by 2026. Local creators bring unique perspectives and insights, which are essential for developing content that resonates with target demographics. Consequently, businesses are increasingly turning to content intelligence tools to analyze the effectiveness of localized content, ensuring that their strategies align with consumer preferences and cultural nuances.

Focus on Enhanced Customer Experience

enhancing customer experience is increasingly a focus of the content intelligence market in South America. Businesses are recognizing that personalized content is crucial for engaging consumers effectively. In 2025, it is anticipated that companies will invest over $3 billion in content intelligence solutions aimed at improving customer interactions. By utilizing data analytics, organizations can tailor their content to meet individual preferences, thereby fostering loyalty and satisfaction. This emphasis on customer experience is likely to drive the adoption of content intelligence tools, as businesses strive to create meaningful connections with their audiences, ultimately contributing to the growth of the content intelligence market.

Rising Demand for Data-Driven Insights

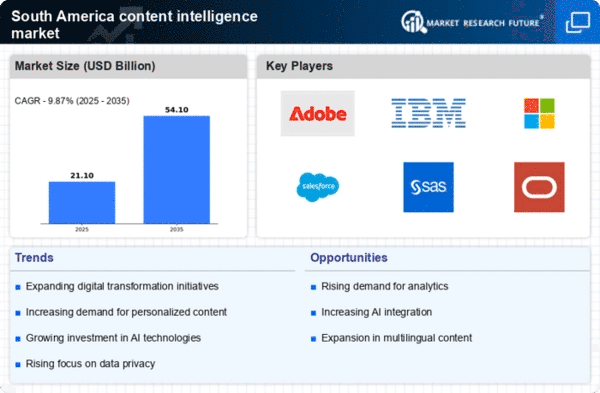

the content intelligence market in South America is experiencing a notable surge in demand for data-driven insights. Businesses increasingly recognize the value of leveraging analytics to enhance decision-making processes. In 2025, the market is projected to grow by approximately 15%, driven by the need for organizations to understand consumer behavior and preferences. This trend is particularly evident in sectors such as retail and e-commerce, where companies utilize content intelligence tools to optimize marketing strategies and improve customer engagement. As organizations strive to remain competitive, the integration of data analytics into content strategies becomes essential, thereby propelling the content intelligence market forward.

Expansion of Digital Marketing Initiatives

the expansion of digital marketing initiatives significantly influences the content intelligence market in South America. As businesses increasingly shift their focus to online platforms, the demand for effective content strategies rises. In 2025, it is estimated that digital marketing expenditures in the region will reach $10 billion, with a substantial portion allocated to content intelligence solutions. Companies are investing in tools that analyze content performance and audience engagement, enabling them to tailor their marketing efforts more effectively. This trend highlights the critical role of content intelligence in driving successful digital marketing campaigns, thereby fostering growth within the content intelligence market.

Increased Investment in Marketing Technology

increased investment in marketing technology benefits the content intelligence market in South America. Companies are allocating larger budgets to adopt advanced tools that enhance content creation and distribution. In 2025, it is projected that marketing technology spending in the region will exceed $5 billion, with a significant portion directed towards content intelligence solutions. This investment reflects a growing recognition of the importance of data-driven content strategies in achieving marketing objectives. As organizations seek to optimize their content performance, the demand for sophisticated content intelligence tools is likely to rise, further propelling market growth.