Adoption of Advanced Technologies

The adoption of advanced technologies, such as machine learning and natural language processing, is driving innovation within the content intelligence market in India. These technologies enable businesses to analyze vast amounts of data and extract meaningful insights that inform content creation and distribution strategies. As organizations increasingly seek to automate and optimize their content processes, the demand for sophisticated content intelligence solutions is likely to rise. The market for artificial intelligence in India is projected to reach $7.8 billion by 2025, indicating a strong inclination towards technology-driven solutions. This trend suggests that businesses are recognizing the potential of advanced technologies to enhance their content strategies, ultimately leading to improved engagement and conversion rates.

Emergence of E-commerce Platforms

The rapid emergence of e-commerce platforms in India is reshaping the content intelligence market. With the rise of online shopping, businesses are compelled to create engaging and relevant content to attract and retain customers. The e-commerce sector in India is projected to reach $200 billion by 2026, highlighting the immense potential for growth. This expansion drives the need for content intelligence solutions that can analyze consumer behavior, preferences, and purchasing patterns. By leveraging content intelligence tools, e-commerce companies can optimize their content strategies, ensuring that they deliver personalized experiences to their customers. This trend indicates a growing reliance on data-driven insights to enhance customer engagement and drive sales in the e-commerce landscape.

Increased Focus on Customer Experience

In the current landscape, there is an increased focus on customer experience, which is significantly impacting the content intelligence market in India. Organizations are recognizing that delivering exceptional customer experiences is crucial for brand loyalty and retention. As a result, businesses are investing in content intelligence solutions to better understand customer needs and preferences. This trend is reflected in the growing adoption of customer feedback mechanisms and analytics tools. Companies that prioritize customer experience are likely to see improved engagement rates and higher conversion rates. The content intelligence market is poised to grow as businesses seek to leverage insights from customer interactions to refine their content strategies and enhance overall satisfaction.

Rising Demand for Data-Driven Insights

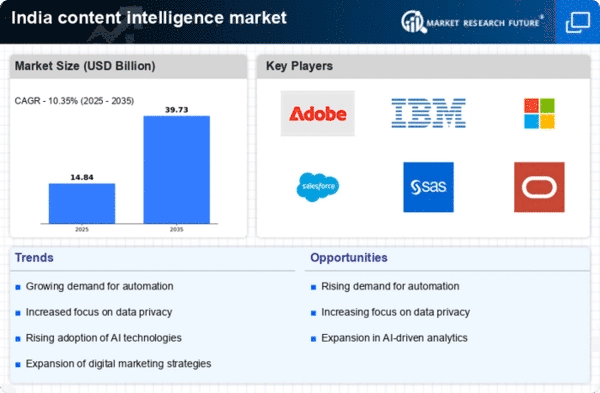

The content intelligence market in India is experiencing a notable surge in demand for data-driven insights. Businesses are increasingly recognizing the value of leveraging data analytics to enhance their content strategies. This trend is driven by the need for organizations to make informed decisions based on consumer behavior and preferences. According to recent estimates, the market for data analytics in India is projected to reach approximately $16 billion by 2025, indicating a robust growth trajectory. As companies seek to optimize their content for better engagement, the content intelligence market is likely to benefit from this growing emphasis on data utilization. The integration of advanced analytics tools enables businesses to tailor their content more effectively, thereby improving customer satisfaction and retention rates.

Growth of Digital Marketing Initiatives

The proliferation of digital marketing initiatives across various sectors in India is significantly influencing the content intelligence market. As organizations shift their focus towards online platforms, the need for effective content strategies becomes paramount. Digital marketing expenditures in India are expected to surpass $10 billion by 2025, reflecting a growing investment in online advertising and content creation. This shift necessitates the use of content intelligence tools to analyze market trends, consumer preferences, and engagement metrics. Consequently, businesses are increasingly adopting content intelligence solutions to enhance their marketing efforts, ensuring that their content resonates with target audiences. The ability to analyze and adapt content strategies in real-time is becoming a critical factor for success in the competitive digital landscape.