Increasing Awareness of Oral Health

There is a notable increase in awareness regarding oral health among the South American population, which is positively impacting the Cbct Dental Market. Educational campaigns and initiatives by health organizations are emphasizing the importance of regular dental check-ups and advanced diagnostic tools. As patients become more informed about the benefits of early detection and treatment, the demand for advanced imaging technologies like CBCT is likely to rise. This heightened awareness is encouraging dental practices to invest in state-of-the-art imaging systems to meet patient expectations. Consequently, the market is projected to expand as more individuals seek comprehensive dental care that includes advanced imaging solutions.

Technological Advancements in Imaging

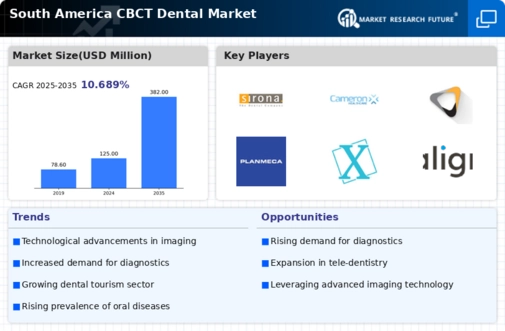

The South America Cbct Dental Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as high-resolution imaging and 3D reconstruction are becoming increasingly prevalent. These advancements allow dental professionals to obtain detailed images of patients' oral structures, leading to improved diagnosis and treatment planning. For instance, the integration of artificial intelligence in imaging software is streamlining workflows and increasing accuracy. As a result, dental practices are more inclined to invest in CBCT systems, which are projected to grow at a compound annual growth rate of approximately 8% in the coming years. This trend indicates a robust market potential driven by the need for precise imaging solutions.

Regulatory Support for Advanced Imaging

Regulatory frameworks in South America are evolving to support the adoption of advanced imaging technologies in the dental sector. Governments are recognizing the importance of modern diagnostic tools, leading to the establishment of guidelines that facilitate the integration of CBCT systems in dental practices. For example, Brazil's National Health Surveillance Agency has implemented regulations that promote the safe use of imaging technologies. This regulatory support is crucial for the South America Cbct Dental Market, as it encourages dental professionals to adopt these technologies, ensuring compliance with safety standards. Consequently, the market is likely to expand as more practitioners seek to enhance their diagnostic capabilities while adhering to regulatory requirements.

Expansion of Dental Practices and Clinics

The South America Cbct Dental Market is benefiting from the expansion of dental practices and clinics across the region. As urbanization continues to rise, more dental professionals are establishing practices in both urban and rural areas, increasing access to dental care. This expansion is accompanied by a growing interest in advanced imaging technologies, as practitioners aim to differentiate their services. The establishment of new clinics is often accompanied by investments in modern equipment, including CBCT systems, to attract patients seeking high-quality care. This trend is expected to contribute to the overall growth of the market, with an anticipated increase in the number of dental practices adopting CBCT technology in the coming years.

Growing Demand for Minimally Invasive Procedures

The South America Cbct Dental Market is witnessing a growing demand for minimally invasive dental procedures. Patients are increasingly seeking treatments that reduce recovery time and discomfort, prompting dental professionals to adopt advanced imaging techniques. CBCT imaging plays a pivotal role in facilitating these procedures by providing accurate assessments of dental structures, which aids in treatment planning. The rise in cosmetic dentistry and orthodontics is particularly notable, with a reported increase in procedures such as dental implants and aligners. This trend is expected to drive the market, as practitioners leverage CBCT technology to enhance patient outcomes and satisfaction, potentially leading to a market growth rate of around 7% over the next few years.