Solvent Recovery System Maintenance and MRO Services Market Summary

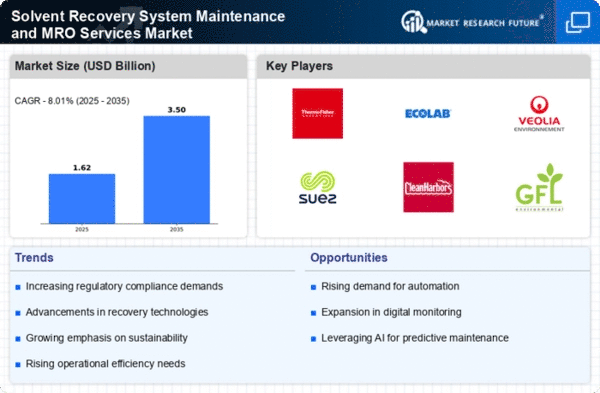

As per MRFR analysis, the Solvent Recovery System Maintenance and MRO Services Market was estimated at 1.5 USD Billion in 2024. The Solvent Recovery System Maintenance and MRO Services industry is projected to grow from 1.62 in 2025 to 3.5 by 2035, exhibiting a compound annual growth rate (CAGR) of 8.01 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Solvent Recovery System Maintenance and MRO Services Market is experiencing a shift towards sustainability and technological integration.

- The market is increasingly driven by a focus on sustainability, with companies seeking to reduce their environmental impact.

- Technological integration is becoming prevalent, enhancing the efficiency and effectiveness of solvent recovery systems.

- Proactive maintenance strategies are gaining traction, allowing businesses to minimize downtime and optimize operations.

- In North America, regulatory compliance pressure and rising costs of raw materials are significant drivers, particularly in the chemical manufacturing segment.

Market Size & Forecast

| 2024 Market Size | 1.5 (USD Billion) |

| 2035 Market Size | 3.5 (USD Billion) |

| CAGR (2025 - 2035) | 8.01% |

Major Players

Thermo Fisher Scientific (US), Ecolab (US), Veolia Environnement (FR), SUEZ (FR), Clean Harbors (US), GFL Environmental (CA), BASF (DE), EnviroTech Services (US), Aqua America (US), Waste Management (US)