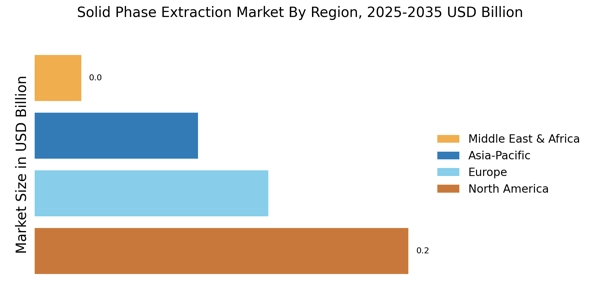

Rising Demand in Environmental Testing

The Solid Phase Extraction Market is witnessing a notable increase in demand driven by the growing focus on environmental testing. As concerns regarding pollution and environmental safety escalate, there is a heightened need for effective analytical methods to detect contaminants in water, soil, and air. Solid phase extraction techniques are favored for their ability to concentrate and purify samples, making them ideal for environmental analysis. The market is projected to see substantial growth as industries and regulatory agencies prioritize environmental monitoring. In fact, the environmental testing segment is anticipated to account for a significant share of the market, reflecting the critical role solid phase extraction plays in ensuring environmental compliance.

Growing Awareness of Analytical Techniques

The Solid Phase Extraction Market is experiencing growth due to the increasing awareness of advanced analytical techniques among researchers and laboratories. As the importance of accurate and reliable data becomes more pronounced, there is a shift towards adopting solid phase extraction methods for sample preparation. Educational initiatives and training programs are enhancing understanding of these techniques, leading to wider acceptance in various fields, including clinical research and forensic analysis. This growing awareness is likely to drive market expansion, as more laboratories recognize the benefits of solid phase extraction in improving analytical outcomes and ensuring data integrity.

Regulatory Compliance and Quality Assurance

The Solid Phase Extraction Market is significantly influenced by stringent regulatory compliance and quality assurance requirements. Regulatory bodies are increasingly mandating the use of solid phase extraction techniques to ensure the accuracy and reliability of analytical results. This is particularly evident in sectors such as food safety and environmental testing, where compliance with regulations is paramount. The market is expected to expand as laboratories adopt solid phase extraction methods to meet these regulatory standards. Furthermore, the increasing emphasis on quality control in laboratories is likely to drive the demand for solid phase extraction products, as they provide a reliable means of sample preparation that aligns with regulatory expectations.

Expanding Applications in Pharmaceutical Industry

The Solid Phase Extraction Market is benefiting from expanding applications within the pharmaceutical sector. As the industry evolves, there is an increasing need for efficient sample preparation methods to support drug development and quality control processes. Solid phase extraction techniques are employed to isolate and purify compounds from complex matrices, facilitating accurate analysis. The pharmaceutical industry is projected to be a major contributor to market growth, with an estimated CAGR of around 6% in the coming years. This growth is attributed to the rising demand for high-quality pharmaceuticals and the need for stringent testing protocols, which solid phase extraction methods effectively address.

Technological Advancements in Solid Phase Extraction

The Solid Phase Extraction Market is experiencing a surge in technological advancements that enhance extraction efficiency and accuracy. Innovations such as automated systems and microextraction techniques are becoming increasingly prevalent. These advancements not only streamline processes but also reduce the time required for sample preparation. For instance, the introduction of solid-phase microextraction (SPME) has revolutionized the way samples are collected and analyzed, leading to improved sensitivity and selectivity. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next few years, driven by the need for more efficient analytical methods in various sectors, including pharmaceuticals and environmental monitoring.