Regulatory Compliance

The Global Environmental Testing Market Industry is significantly driven by stringent regulatory frameworks imposed by governments worldwide. These regulations mandate regular testing of air, water, and soil to ensure compliance with environmental standards. For instance, the U.S. Environmental Protection Agency (EPA) enforces regulations that require industries to monitor and report their environmental impact. This compliance not only safeguards public health but also enhances corporate responsibility. As a result, the demand for environmental testing services is projected to grow, contributing to the market's expansion, which is expected to reach 17.3 USD Billion in 2024.

Global Health Initiatives

The Global Environmental Testing Market Industry is also influenced by global health initiatives aimed at improving public health through environmental monitoring. Organizations such as the World Health Organization (WHO) emphasize the importance of clean air and water for health outcomes. These initiatives encourage governments to invest in environmental testing to identify and mitigate health risks associated with pollution. As awareness of the link between environmental quality and health continues to grow, the demand for testing services is expected to rise, further propelling market growth.

Market Growth Projections

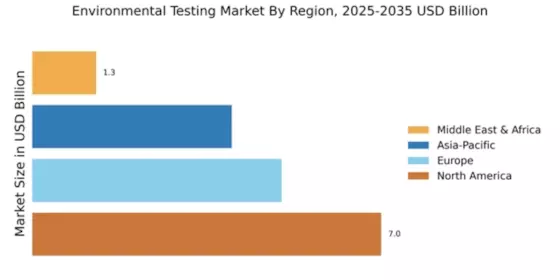

The Global Environmental Testing Market Industry is poised for substantial growth, with projections indicating a market size of 17.3 USD Billion in 2024 and an anticipated increase to 32.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.83% from 2025 to 2035. The expansion is driven by various factors, including regulatory compliance, technological advancements, and rising environmental concerns. As industries and governments prioritize environmental sustainability, the demand for comprehensive testing services will likely continue to rise, shaping the future landscape of the market.

Technological Advancements

Innovations in testing technologies are transforming the Global Environmental Testing Market Industry. The introduction of advanced analytical techniques, such as mass spectrometry and chromatography, enhances the accuracy and efficiency of environmental testing. These technologies enable faster detection of pollutants and contaminants, thereby facilitating timely interventions. Moreover, the integration of automation and data analytics in testing processes streamlines operations and reduces costs. As industries seek to adopt these cutting-edge technologies to comply with regulations and improve sustainability practices, the market is expected to experience a compound annual growth rate of 5.83% from 2025 to 2035.

Rising Environmental Concerns

Growing awareness regarding environmental degradation and its impacts on health and ecosystems propels the Global Environmental Testing Market Industry. Public concern over pollution, climate change, and biodiversity loss has led to increased demand for environmental testing services. Governments and organizations are investing in monitoring programs to assess and mitigate environmental risks. For example, initiatives aimed at reducing carbon emissions and improving water quality are driving the need for comprehensive testing. This heightened focus on environmental sustainability is likely to contribute to the market's growth, with projections indicating a rise to 32.2 USD Billion by 2035.

Industrial Growth and Urbanization

Rapid industrialization and urbanization are key factors driving the Global Environmental Testing Market Industry. As cities expand and industries proliferate, the potential for environmental pollution increases, necessitating rigorous testing to monitor air and water quality. Urban areas often face challenges related to waste management and resource depletion, prompting governments to implement testing programs. For instance, developing countries are investing in environmental testing to address pollution from industrial activities. This trend is likely to bolster the market, as the need for environmental assessments becomes more critical in densely populated regions.