Rising Electricity Costs

The increasing cost of electricity is a significant driver for the Global Solar Rooftop Market Industry. As utility rates continue to rise, consumers are seeking alternative energy solutions to mitigate their energy expenses. Solar rooftops provide a viable option, allowing users to generate their own electricity and reduce reliance on grid power. This shift not only offers potential savings but also enhances energy independence. The financial benefits associated with solar energy adoption are becoming increasingly apparent, further propelling the market forward as more individuals and businesses consider solar installations as a long-term investment.

Market Growth Projections

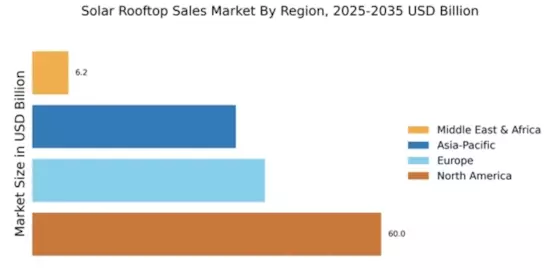

The Global Solar Rooftop Market Industry is poised for remarkable growth, with projections indicating a market size of 1108.5 USD Billion by 2035. This anticipated expansion reflects a robust compound annual growth rate of 20.6% from 2025 to 2035, driven by various factors including technological advancements, government incentives, and rising electricity costs. As more consumers and businesses recognize the benefits of solar energy, the market is likely to witness increased investments and innovations. The upward trajectory of the solar rooftop market underscores its potential to play a pivotal role in the global transition towards renewable energy.

Technological Advancements

Technological advancements are pivotal in shaping the Global Solar Rooftop Market Industry. Innovations in solar panel technology, such as bifacial panels and improved energy storage solutions, are enhancing the efficiency and reliability of solar energy systems. These advancements are likely to attract more consumers, as they promise higher energy yields and lower costs over time. Furthermore, the integration of smart technologies allows for better energy management, making solar rooftops more appealing to both residential and commercial users. This trend is expected to contribute to a compound annual growth rate of 20.6% from 2025 to 2035.

Government Incentives and Policies

Government incentives and supportive policies play a crucial role in the expansion of the Global Solar Rooftop Market Industry. Various countries are introducing tax credits, rebates, and feed-in tariffs to encourage solar energy adoption. For instance, in several regions, homeowners can benefit from significant financial incentives that lower the initial investment costs for solar installations. These measures not only stimulate market growth but also contribute to achieving national renewable energy targets. As a result, the market is expected to grow substantially, with projections indicating a market size of 1108.5 USD Billion by 2035.

Growing Demand for Renewable Energy

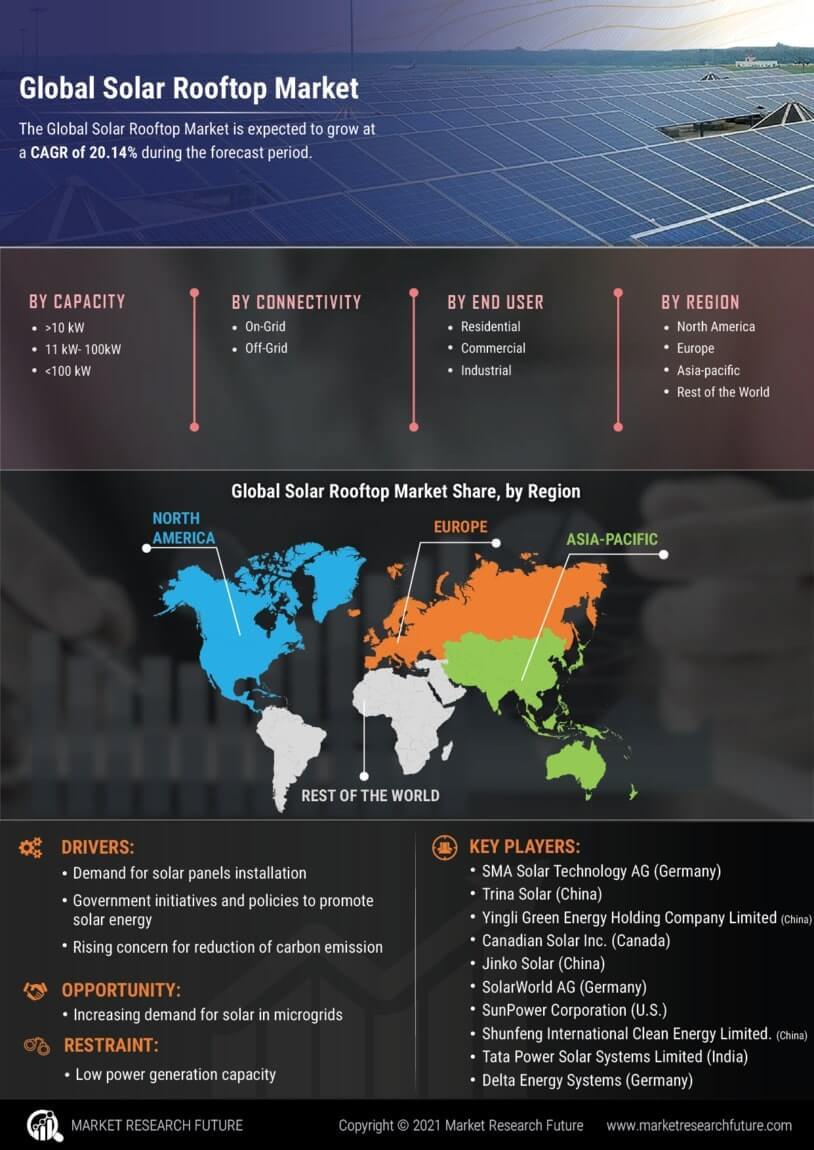

The Global Solar Rooftop Market Industry is experiencing a surge in demand for renewable energy solutions, driven by increasing awareness of climate change and the need for sustainable energy sources. Governments worldwide are implementing policies and incentives to promote solar energy adoption, which is reflected in the projected market size of 141.2 USD Billion in 2024. This growing demand is further supported by technological advancements that enhance solar panel efficiency and reduce costs, making solar rooftops a more attractive option for residential and commercial properties alike.

Environmental Concerns and Sustainability

Environmental concerns are increasingly influencing consumer behavior, thereby impacting the Global Solar Rooftop Market Industry. As awareness of the environmental impact of fossil fuels grows, more individuals and businesses are opting for solar energy solutions to reduce their carbon footprint. This shift towards sustainability is supported by various international agreements aimed at reducing greenhouse gas emissions. Consequently, the demand for solar rooftops is likely to rise as more stakeholders recognize the importance of sustainable energy practices. This trend aligns with the broader global movement towards cleaner energy sources and responsible consumption.