Growing Demand for Bandwidth

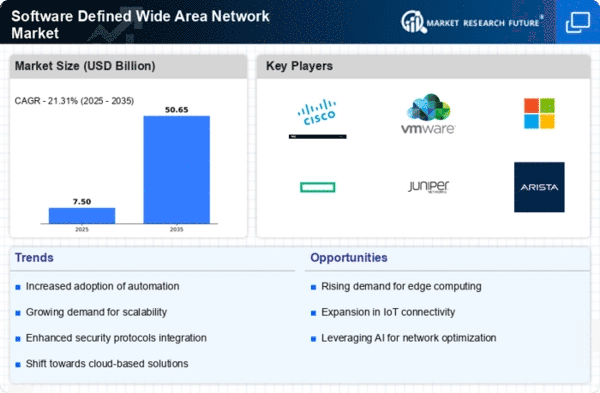

The Software Defined Wide Area Network Market is experiencing a notable surge in demand for bandwidth, driven by the increasing number of connected devices and the proliferation of data-intensive applications. Organizations are seeking solutions that can efficiently manage and optimize their network resources to accommodate this growing demand. According to recent estimates, the global data traffic is expected to increase exponentially, with projections indicating a compound annual growth rate of over 20 percent in the coming years. This trend necessitates the adoption of software-defined networking solutions that can dynamically allocate bandwidth and enhance overall network performance. As businesses strive to improve their operational efficiency and user experience, the Software Defined Wide Area Network Market is likely to benefit from this heightened focus on bandwidth management.

Enhanced Network Security Features

As cyber threats continue to evolve, the Software Defined Wide Area Network Market is witnessing a heightened emphasis on enhanced network security features. Organizations are increasingly aware of the vulnerabilities associated with traditional WAN architectures, which often lack the agility to respond to emerging threats. Software-defined networking solutions provide advanced security capabilities, such as real-time traffic monitoring, automated threat detection, and integrated security policies. These features not only bolster the overall security posture of organizations but also facilitate compliance with regulatory requirements. The market for network security solutions is projected to grow significantly, with estimates suggesting a potential increase of over 15 percent annually. Consequently, the Software Defined Wide Area Network Market is likely to thrive as businesses prioritize security in their network strategies.

Integration with Internet of Things (IoT)

The integration of Software Defined Wide Area Network Market with the Internet of Things (IoT) is emerging as a critical driver of growth. As IoT devices proliferate across various sectors, the need for robust and scalable networking solutions becomes paramount. Software-defined networking offers the flexibility and adaptability required to manage the diverse and dynamic nature of IoT traffic. This integration enables organizations to efficiently connect, monitor, and control a multitude of devices, thereby enhancing operational efficiency and data collection capabilities. Market analysts predict that the number of connected IoT devices will reach several billion in the next few years, further underscoring the necessity for advanced networking solutions. The Software Defined Wide Area Network Market is poised to capitalize on this trend, providing the infrastructure needed to support the burgeoning IoT ecosystem.

Support for Remote Work and Collaboration

The shift towards remote work and collaboration is significantly influencing the Software Defined Wide Area Network Market. As organizations adapt to flexible work arrangements, the demand for reliable and secure network solutions has intensified. Software-defined networking enables seamless connectivity for remote employees, ensuring that they can access critical applications and data from any location. This capability is particularly vital in enhancing productivity and collaboration among distributed teams. Recent studies indicate that companies utilizing software-defined networking solutions report improved employee satisfaction and operational efficiency. As the trend of remote work continues to evolve, the Software Defined Wide Area Network Market is likely to see sustained growth, driven by the need for adaptable and resilient networking solutions.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a pivotal driver within the Software Defined Wide Area Network Market, as organizations increasingly seek to reduce operational expenses while maintaining high-quality network performance. Traditional WAN architectures often entail significant capital expenditures and ongoing maintenance costs. In contrast, software-defined solutions offer a more flexible and cost-effective approach, enabling businesses to scale their networks according to demand without incurring substantial costs. Research indicates that enterprises can achieve up to 30 percent savings in operational costs by transitioning to software-defined networking. This financial incentive, coupled with the ability to rapidly deploy and manage network resources, positions the Software Defined Wide Area Network Market as an attractive option for organizations aiming to optimize their IT budgets.