Research Methodology on Smart Ticketing Market

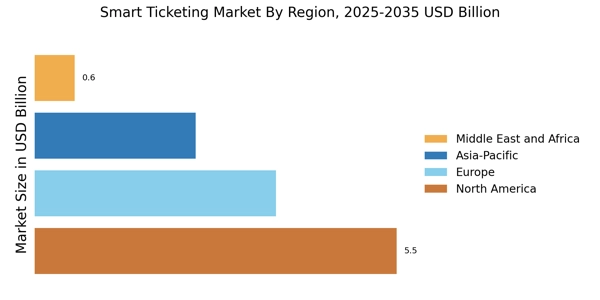

This research report focuses on Smart Ticketing Market globally, particularly in North America, Europe, Asia-Pacific, Middle East & Africa and South America. It also covers a segmentation of the market based on types, components, end users, and regions.

Introduction

The smart ticketing market focuses on the sale and use of smart tickets for travel and other services. Smart tickets are cards that are electronically enabled, which contain information about the customer, such as their payment details, ticket booking details, and travel route. This allows the customer to pay for their ticket and services without resorting to physical documents. Smart ticketing is rapidly becoming the preferred method of payment amongst travellers as it is more convenient and secure as compared to traditional methods.

Research Aim & Objectives

The primary aim of this research is to evaluate the current trends in the smart ticketing market globally, particularly in North America, Europe, Asia-Pacific, Middle East & Africa and South America. There are several objectives to this research project which are listed as follows:

- To identify the latest market dynamics of the global smart ticketing market.

- To analyze the demand for smart ticketing services in the North American, European, Asia-Pacific, Middle East & Africa and South American regions.

- To assess the impact of technological advancements and government regulations on the growth of the global smart ticketing market.

- To analyze various marketing strategies that are employed by smart ticketing providers.

- To provide a detailed analysis of the competitive landscape of the global smart ticketing market.

- To identify the opportunities, challenges and key players in the global smart ticketing market.

Research Methodology

This research utilizes both primary and secondary research methods to gather data. The primary data will be collected through interviews with passengers who have used smart ticketing, providers of smart ticketing services, government institutions, financial institutions and regulatory bodies. This will give an insight into customer behaviour and the challenges faced by providers. The secondary research method will include an analysis of the current market trends based on reports, surveys and industry publications.

Information about the market size, growth rate and market segments is obtained from both primary and secondary sources. This includes a review of the latest industry reports, annual reports and press releases from companies in the smart ticketing market. Industry experts and consultants are also consulted for their views on the current market trends and predictions for the future.

Data Analysis

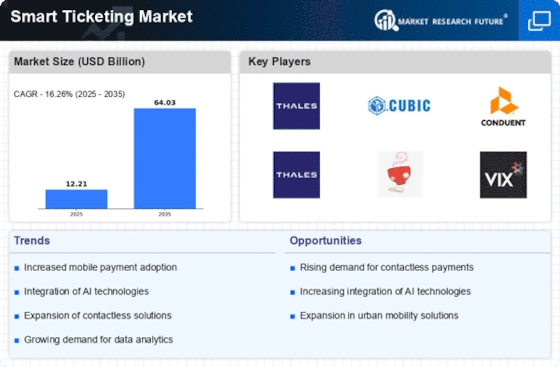

The collected data is analyzed using the Market Research Future framework. This includes an analysis of the market size, growth rate, opportunities, challenges and key players in the market. The data is further analyzed to determine the factors that are driving the growth of the global smart ticketing market. These include the impact of technological advancements, government regulations, customer behaviour and marketing strategies.

The data is presented in the form of tables, figures and graphs to better illustrate the trends and developments in the global market.

Conclusion

The research report aims to provide a comprehensive analysis of the global smart ticketing market. It will analyze the current market dynamics and identify potential growth opportunities. The research will also provide insight into the customer behaviour that is driving the demand for smart tickets and the challenges faced by service providers. It will further provide an overview of the competitive landscape in the global market, with a focus on the leading players in the market.