North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Smart Manufacturing Equipment Repair and MRO Services Market, holding a significant market share of 12.5 in 2024. The region's growth is driven by rapid technological advancements, increased automation, and a strong focus on sustainability. Regulatory support for smart manufacturing initiatives further fuels demand, as companies seek to enhance operational efficiency and reduce downtime.

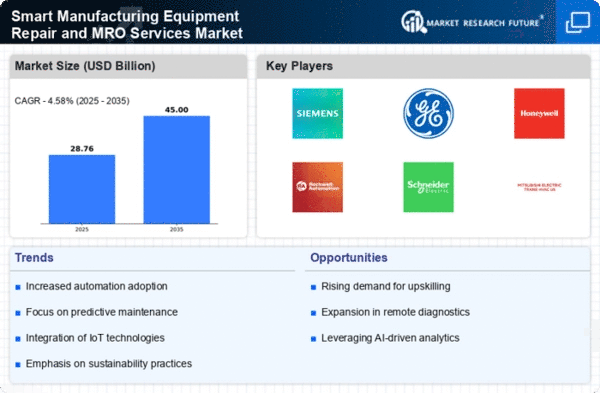

The competitive landscape in North America is robust, featuring key players such as Siemens, General Electric, and Honeywell. The U.S. stands out as a leader in adopting smart manufacturing technologies, supported by substantial investments in R&D. The presence of major corporations and a skilled workforce positions North America as a hub for innovation and excellence in MRO services.

Europe : Emerging Market with Potential

Europe is witnessing a growing interest in Smart Manufacturing Equipment Repair and MRO Services, with a market size of 8.0 in 2024. The region's growth is propelled by stringent regulations aimed at enhancing industrial efficiency and sustainability. Countries are increasingly adopting smart technologies to comply with environmental standards, driving demand for advanced repair and maintenance services.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with significant investments in smart manufacturing initiatives. Key players like Schneider Electric and ABB are actively expanding their presence in the region, contributing to a competitive landscape that fosters innovation and collaboration. The European market is expected to continue evolving as companies prioritize digital transformation and operational excellence.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is emerging as a significant player in the Smart Manufacturing Equipment Repair and MRO Services Market, with a market size of 5.5 in 2024. The region's growth is driven by rapid industrialization, increasing investments in smart technologies, and a growing emphasis on operational efficiency. Governments are implementing policies to support the adoption of advanced manufacturing practices, further boosting market demand.

Countries like Japan, China, and South Korea are leading the charge, with major companies such as Mitsubishi Electric and Fanuc playing pivotal roles. The competitive landscape is characterized by a mix of established players and innovative startups, fostering a dynamic environment for growth. As the region continues to embrace smart manufacturing, the demand for MRO services is expected to rise significantly.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually recognizing the potential of the Smart Manufacturing Equipment Repair and MRO Services Market, with a market size of 1.5 in 2024. The growth is primarily driven by increasing investments in industrial infrastructure and a shift towards automation. Governments are focusing on diversifying their economies, which includes enhancing manufacturing capabilities and adopting smart technologies.

Countries like South Africa and the UAE are leading the way in this transformation, with initiatives aimed at modernizing their industrial sectors. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region continues to evolve, the demand for MRO services is expected to grow, driven by the need for efficient and reliable manufacturing processes.