North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Battery Manufacturing Equipment MRO Services Market, holding a market size of $5.0 billion in 2025. The region's growth is driven by increasing demand for electric vehicles (EVs) and renewable energy solutions, alongside stringent regulations promoting sustainable manufacturing practices. The presence of advanced technology and significant investments in R&D further bolster market expansion.

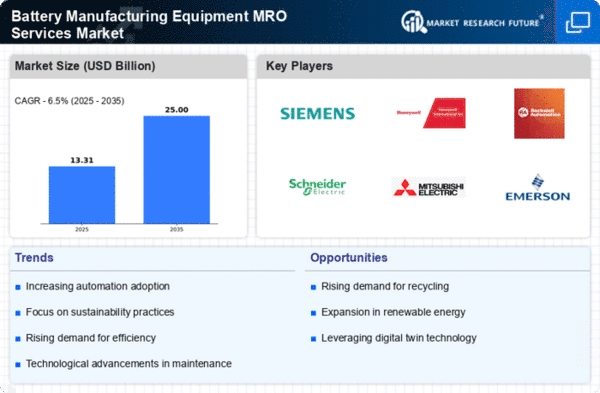

The competitive landscape is characterized by major players such as Siemens AG, Honeywell International Inc., and Rockwell Automation Inc. These companies leverage innovative technologies to enhance service offerings. The U.S. and Canada are the leading countries, with a robust infrastructure supporting battery manufacturing. The market is expected to grow as industries increasingly prioritize maintenance, repair, and operational efficiency.

Europe : Emerging Hub for Innovation

Europe is rapidly evolving as a key player in the Battery Manufacturing Equipment MRO Services Market, with a market size of $3.5 billion projected for 2025. The region benefits from strong governmental support for green technologies and a shift towards sustainable energy solutions. Regulatory frameworks, such as the European Green Deal, are driving investments in battery production and maintenance, fostering a favorable environment for MRO services.

Leading countries like Germany, France, and the UK are at the forefront of this growth, hosting major companies such as Schneider Electric SE and Bosch Rexroth AG. The competitive landscape is marked by innovation and collaboration among industry players, enhancing service capabilities. As the demand for electric mobility rises, the MRO services market is expected to expand significantly, supported by a skilled workforce and advanced manufacturing technologies.

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is witnessing significant growth in the Battery Manufacturing Equipment MRO Services Market, with a projected market size of $3.0 billion by 2025. The region's expansion is fueled by increasing investments in electric vehicle production and a growing emphasis on renewable energy sources. Countries are implementing supportive policies to enhance battery manufacturing capabilities, driving demand for MRO services in the sector.

China, Japan, and South Korea are the leading countries in this market, with major players like Mitsubishi Electric Corporation and Yaskawa Electric Corporation actively participating. The competitive landscape is dynamic, with companies focusing on technological advancements and strategic partnerships to improve service delivery. As the region continues to develop its battery manufacturing infrastructure, the MRO services market is expected to thrive, catering to the rising demand for efficient maintenance solutions.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually emerging in the Battery Manufacturing Equipment MRO Services Market, with a market size of $1.0 billion anticipated by 2025. The growth is driven by increasing investments in renewable energy projects and a rising demand for electric vehicles. Governments are beginning to recognize the importance of battery technology, leading to supportive policies that encourage local manufacturing and maintenance services.

Countries like South Africa and the UAE are taking the lead in this market, with a focus on developing infrastructure for battery production. The competitive landscape is still developing, with opportunities for both local and international players to establish a presence. As the region continues to invest in sustainable energy solutions, the MRO services market is expected to grow, driven by the need for efficient operational support.