Increased Urbanization

The trend of urbanization is significantly impacting the Small Bulldozer Market. As populations migrate towards urban centers, the demand for housing, commercial spaces, and infrastructure is escalating. Small bulldozers are essential for land clearing, grading, and site preparation in densely populated areas where larger machinery may not be feasible. Recent statistics suggest that urban areas are expected to house nearly 70% of the world's population by 2050, creating a substantial market for small bulldozers. This urban expansion necessitates efficient construction practices, further solidifying the role of small bulldozers in the industry. Consequently, the Small Bulldozer Market is poised for growth as urbanization continues to reshape landscapes.

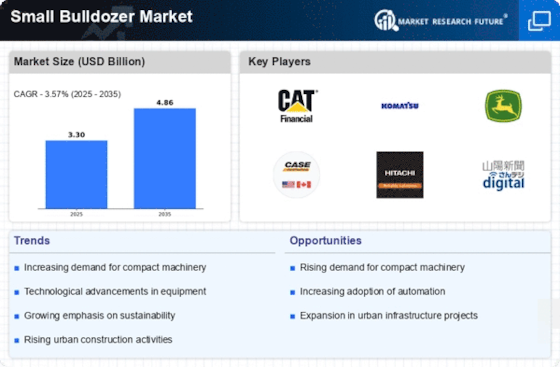

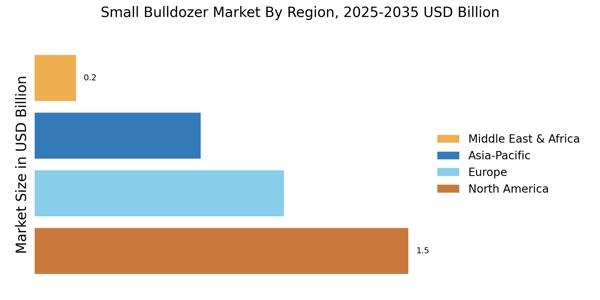

Infrastructure Development

The ongoing expansion of infrastructure projects appears to be a primary driver for the Small Bulldozer Market. Governments and private entities are increasingly investing in roads, bridges, and urban development, necessitating the use of small bulldozers for efficient earthmoving and site preparation. In recent years, the demand for small bulldozers has surged, with the market projected to grow at a compound annual growth rate of approximately 4.5% through the next five years. This growth is likely fueled by the need for compact machinery that can operate in confined spaces, making small bulldozers an ideal choice for urban construction sites. As infrastructure projects continue to proliferate, the Small Bulldozer Market is expected to benefit significantly from this trend.

Technological Advancements

Technological innovations are reshaping the Small Bulldozer Market, enhancing the efficiency and capabilities of these machines. Recent advancements in automation, telematics, and machine learning are enabling operators to achieve higher productivity levels while minimizing operational costs. For instance, the integration of GPS technology allows for precise grading and earthmoving, reducing material waste and improving project timelines. Furthermore, the introduction of electric and hybrid models is addressing environmental concerns, appealing to a broader range of customers. As these technologies continue to evolve, they are expected to drive the Small Bulldozer Market, attracting new entrants and encouraging existing manufacturers to innovate.

Rising Demand for Compact Equipment

The increasing preference for compact construction equipment is influencing the Small Bulldozer Market. As construction sites become more congested, the need for machinery that can maneuver in tight spaces is paramount. Small bulldozers, known for their agility and versatility, are becoming the equipment of choice for contractors. Market data indicates that the sales of small bulldozers have risen by approximately 15% over the past two years, reflecting this shift in demand. Additionally, the trend towards smaller, more efficient machines aligns with sustainability goals, as they typically consume less fuel and produce fewer emissions. This growing inclination towards compact equipment is likely to propel the Small Bulldozer Market forward in the coming years.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting sustainable construction practices are influencing the Small Bulldozer Market. Many regions are implementing stricter emissions standards and encouraging the adoption of eco-friendly machinery. Small bulldozers, particularly those that are electric or hybrid, are increasingly favored due to their lower environmental impact. Additionally, various government programs offer financial incentives for contractors to invest in cleaner technologies, further driving demand for small bulldozers. Market analysis indicates that regions with robust regulatory frameworks are witnessing a faster adoption of these machines. As sustainability becomes a priority, the Small Bulldozer Market is likely to experience a shift towards more environmentally friendly options.