Market Growth Projections

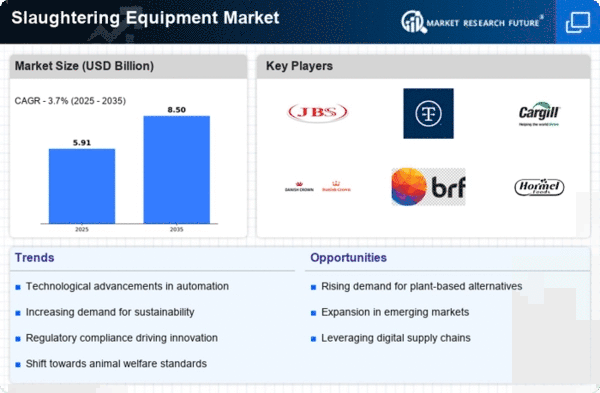

The Global Slaughtering Equipment Market Industry is poised for substantial growth, with projections indicating a market value of 8.5 USD Billion by 2035. This growth is underpinned by various factors, including increasing meat consumption, technological advancements, and regulatory compliance. The anticipated CAGR of 3.7% from 2025 to 2035 suggests a steady expansion trajectory, reflecting the industry's adaptability to changing consumer preferences and market conditions. As the global population continues to rise, the demand for efficient and sustainable slaughtering solutions is likely to drive innovation and investment in the sector.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Slaughtering Equipment Market Industry. Innovations in automation, robotics, and data analytics are enhancing operational efficiency and safety in slaughtering processes. For instance, the integration of AI-driven systems allows for real-time monitoring and quality control, which can significantly reduce waste and improve yield. As the industry evolves, companies are likely to invest in these technologies to remain competitive. This trend is expected to contribute to the market's growth, with projections indicating a CAGR of 3.7% from 2025 to 2035, underscoring the importance of technological integration in future operations.

Increasing Meat Consumption

The Global Slaughtering Equipment Market Industry is experiencing growth driven by rising meat consumption worldwide. As populations expand and dietary preferences shift towards protein-rich foods, the demand for efficient slaughtering equipment increases. In 2024, the market is valued at 5.7 USD Billion, reflecting the industry's response to heightened consumer demand. Countries with growing populations, such as India and China, are particularly influential, as they seek to modernize their meat processing facilities. This trend suggests that the industry must adapt to meet the needs of a more health-conscious consumer base, potentially leading to innovations in slaughtering technologies.

Global Trade and Export Opportunities

The Global Slaughtering Equipment Market Industry is benefiting from expanding global trade and export opportunities. Countries with established meat processing industries are increasingly exporting their products to meet global demand. This trend is particularly evident in regions like North America and Europe, where advanced slaughtering technologies are in high demand. As international trade agreements facilitate easier access to foreign markets, manufacturers are likely to explore new opportunities for growth. The projected market value of 8.5 USD Billion by 2035 indicates the potential for significant expansion, driven by both domestic and international market dynamics.

Regulatory Compliance and Food Safety

The Global Slaughtering Equipment Market Industry is increasingly influenced by stringent regulatory compliance and food safety standards. Governments worldwide are implementing more rigorous regulations to ensure the humane treatment of animals and the safety of meat products. This has led to a demand for advanced slaughtering equipment that meets these standards. For example, the European Union has established comprehensive guidelines that require slaughterhouses to adopt specific technologies to enhance animal welfare. As a result, manufacturers are compelled to innovate and upgrade their equipment, which not only ensures compliance but also enhances their market position in a competitive landscape.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are emerging as critical drivers in the Global Slaughtering Equipment Market Industry. As consumers become more environmentally conscious, there is a growing demand for equipment that minimizes waste and reduces carbon footprints. This trend is prompting manufacturers to develop eco-friendly technologies, such as energy-efficient machinery and waste recycling systems. The industry's shift towards sustainability is not only a response to consumer preferences but also aligns with global initiatives aimed at reducing environmental impact. This focus on sustainability may influence market dynamics, as companies that prioritize eco-friendly practices could gain a competitive edge.