Growth in Oil and Gas Sector

The oil and gas industry is experiencing a resurgence, which significantly influences the Silica Aerogel Market. Silica aerogel's unique properties, such as its thermal insulation capabilities, are increasingly utilized in upstream and downstream applications. In 2025, the market for silica aerogel in the oil and gas sector is expected to expand, driven by the need for efficient thermal management in pipelines and storage facilities. The material's ability to withstand extreme temperatures and pressures makes it a preferred choice for enhancing operational efficiency. As exploration and production activities ramp up, the demand for advanced materials like silica aerogel is likely to increase, thereby bolstering the overall market.

Rising Demand for Energy Efficiency

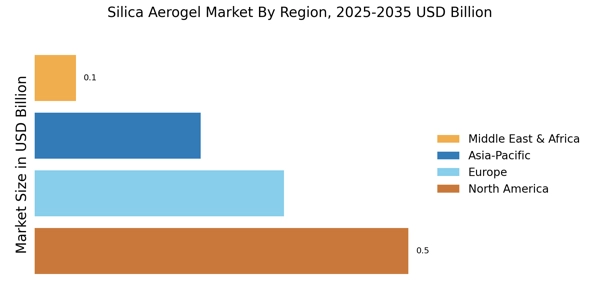

The increasing emphasis on energy efficiency across various sectors appears to be a primary driver for the Silica Aerogel Market. As industries strive to reduce energy consumption and carbon footprints, the lightweight and insulating properties of silica aerogel make it an attractive option. In 2025, the demand for energy-efficient materials is projected to grow, with the silica aerogel market potentially reaching a valuation of over 1 billion USD. This trend is particularly evident in the construction and automotive sectors, where insulation materials are critical for enhancing energy performance. The shift towards sustainable building practices further propels the adoption of silica aerogel, as it aligns with regulatory frameworks aimed at reducing energy use.

Advancements in Manufacturing Techniques

Innovations in manufacturing processes are poised to transform the Silica Aerogel Market. Recent advancements, such as improved sol-gel methods and supercritical drying techniques, have enhanced the production efficiency and scalability of silica aerogels. These developments not only reduce production costs but also improve the material's performance characteristics. As of 2025, the market is witnessing a shift towards more sustainable and cost-effective production methods, which could potentially increase the availability of silica aerogel for various applications. This trend is likely to attract new players into the market, fostering competition and driving further innovation in product offerings.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are significantly influencing the Silica Aerogel Market. Governments worldwide are implementing policies aimed at reducing environmental impact, which encourages the adoption of eco-friendly materials like silica aerogel. In 2025, the market is likely to benefit from incentives and subsidies aimed at promoting energy-efficient building materials. This regulatory support is expected to drive demand across various sectors, including construction and automotive, where compliance with environmental standards is becoming increasingly stringent. As a result, silica aerogel is positioned to play a pivotal role in meeting these regulatory requirements, thereby enhancing its market presence.

Increasing Investment in Research and Development

Investment in research and development is a crucial driver for the Silica Aerogel Market. As industries recognize the potential of silica aerogel in various applications, funding for R&D initiatives is on the rise. In 2025, it is anticipated that companies will allocate more resources towards exploring new applications, such as in aerospace, electronics, and healthcare. This focus on innovation is expected to yield novel products and solutions that leverage the unique properties of silica aerogel. The influx of investment not only enhances product development but also encourages collaboration between academia and industry, fostering a robust ecosystem for growth.