Health-Conscious Reformulation

The Shortening Fats Market is experiencing a notable shift towards health-conscious reformulation. Consumers are increasingly seeking products that align with their health goals, prompting manufacturers to innovate. This trend is reflected in the growing demand for trans-fat-free shortening options, which has surged by approximately 25% in recent years. As a result, companies are reformulating their products to reduce unhealthy fats while maintaining desirable textures and flavors. This reformulation not only caters to consumer preferences but also complies with regulatory standards aimed at reducing trans fats in food products. The emphasis on health and wellness is likely to continue driving growth in the Shortening Fats Market, as brands strive to meet the evolving expectations of health-conscious consumers.

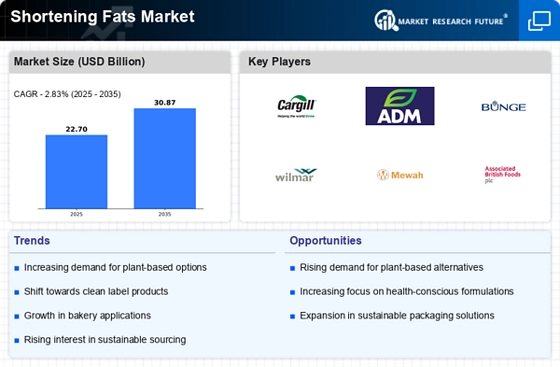

Rise of Plant-Based Alternatives

The Shortening Fats Market is witnessing a significant rise in the popularity of plant-based alternatives. As consumers become more aware of the environmental and health implications of animal-based products, the demand for plant-derived shortening options is increasing. This shift is evidenced by a reported 30% growth in sales of plant-based shortening over the past two years. Manufacturers are responding by developing innovative products that utilize ingredients such as coconut oil, palm oil, and other vegetable fats. These alternatives not only appeal to vegan food and vegetarian consumers but also attract those seeking to reduce their carbon footprint. The rise of plant-based alternatives is expected to reshape the landscape of the Shortening Fats Market, as more brands introduce sustainable and health-oriented options.

Specialty Fats for Diverse Diets

The Shortening Fats Market is adapting to the growing demand for specialty fats that cater to diverse dietary needs. With the increasing prevalence of dietary restrictions, such as gluten-free, keto, and paleo diets, manufacturers are developing specialized shortening products that meet these requirements. This trend is supported by market data indicating a 20% increase in sales of specialty fats over the last year. These products not only provide functional benefits in baking and cooking but also align with the lifestyle choices of health-conscious consumers. As the market continues to diversify, the introduction of specialty fats is likely to enhance the competitive landscape of the Shortening Fats Market, offering consumers more tailored options.

Sustainability and Ethical Sourcing

Sustainability and ethical sourcing are becoming increasingly pivotal in the Shortening Fats Market. Consumers are more inclined to purchase products that are produced with environmentally friendly practices and ethically sourced ingredients. This trend is reflected in the growing demand for shortening fats that are certified organic or non-GMO, with a reported increase of 15% in sales of such products. Manufacturers are responding by implementing sustainable practices in their supply chains, including responsible sourcing of palm oil and other raw materials. This focus on sustainability not only appeals to environmentally conscious consumers but also enhances brand loyalty. As the Shortening Fats Market evolves, the emphasis on sustainability is likely to play a crucial role in shaping consumer preferences and purchasing decisions.

Technological Advancements in Production

Technological advancements in production processes are significantly influencing the Shortening Fats Market. Innovations in manufacturing techniques, such as enzymatic interesterification and advanced refining methods, are enabling producers to create high-quality shortening fats with improved functionality. These advancements have led to a reported 10% increase in production efficiency, allowing manufacturers to meet rising consumer demand more effectively. Furthermore, technology is facilitating the development of healthier shortening options that retain desirable properties for baking and cooking. As these technologies continue to evolve, they are likely to enhance the competitive edge of companies within the Shortening Fats Market, driving growth and innovation.