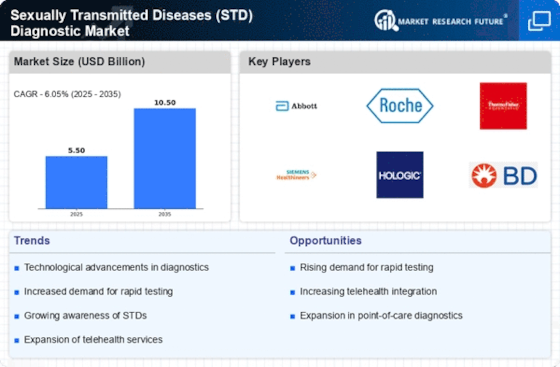

Rising Incidence of STDs

The increasing prevalence of sexually transmitted diseases (STDs) is a primary driver for the Sexually Transmitted Diseases (STD) Diagnostics Market, with enhanced STD testing capabilities becoming essential for effective outbreak management.

Recent data indicates that the incidence of STDs, such as chlamydia, gonorrhea, and syphilis, has been on the rise, particularly among young adults and marginalized populations. This trend necessitates enhanced diagnostic capabilities to manage and control outbreaks effectively.

As the World Health Organization reports over 1 million new infections daily, the need for accessible STD testing has never been more critical.

As awareness of STDs grows, healthcare providers are compelled to invest in advanced diagnostic tools, thereby propelling the market forward. The rising incidence not only highlights the need for better diagnostics but also emphasizes the importance of preventive measures and education in combating STDs.

Rising Healthcare Expenditure

The upward trend in healthcare expenditure is a significant factor influencing the Sexually Transmitted Diseases (STD) Diagnostics Market. As countries allocate more resources to healthcare, there is a corresponding increase in funding for STD prevention, diagnosis, and treatment. This financial commitment allows for the procurement of advanced diagnostic technologies and the implementation of comprehensive screening programs. According to recent reports, healthcare spending is projected to rise, driven by the need for improved health outcomes and the management of chronic diseases, including STDs. Increased investment in healthcare infrastructure also facilitates better access to diagnostic services, particularly in underserved areas. As healthcare systems evolve, the emphasis on preventive care and early diagnosis becomes paramount, thereby propelling the growth of the STD diagnostic market.

Government Initiatives and Funding

Government initiatives aimed at combating sexually transmitted diseases (STDs) significantly influence the Sexually Transmitted Diseases (STD) Diagnostics Market. Various health departments and organizations are increasingly allocating funds to enhance STD screening and treatment programs. For instance, initiatives that promote regular testing and early diagnosis are crucial in reducing transmission rates. In many regions, public health campaigns are being launched to educate the population about STDs, which in turn drives demand for diagnostic services. The financial support from governments facilitates the development and distribution of innovative diagnostic technologies, making them more accessible to healthcare providers. This proactive approach not only aids in early detection but also fosters a collaborative environment among stakeholders, including healthcare professionals and researchers, to address the STD epidemic effectively.

Increased Public Awareness and Education

The growing public awareness regarding sexually transmitted diseases (STDs) is a crucial driver for the Sexually Transmitted Diseases (STD) Diagnostics Market. Educational campaigns aimed at informing individuals about the risks associated with STDs and the importance of regular testing have gained momentum. As people become more knowledgeable about STDs, they are more likely to seek diagnostic services, leading to increased demand in the market. This heightened awareness is particularly evident among younger populations, who are more engaged in discussions about sexual health. Moreover, social media platforms and community outreach programs have played a significant role in disseminating information, further encouraging individuals to prioritize their sexual health. Consequently, this trend not only boosts the demand for diagnostic services but also fosters a culture of proactive health management.

Technological Innovations in Diagnostics

Technological advancements play a pivotal role in shaping the Sexually Transmitted Diseases (STD) Diagnostics Market. Innovations such as point-of-care testing, molecular diagnostics, and rapid test kits have revolutionized the way STDs are diagnosed. These technologies offer faster results, improved accuracy, and greater convenience for patients. For example, the introduction of nucleic acid amplification tests (NAATs) has significantly enhanced the detection rates of STDs, leading to timely treatment and better health outcomes. The market is witnessing a surge in demand for these advanced diagnostic tools, as they enable healthcare providers to offer efficient and effective care. Furthermore, the integration of artificial intelligence and machine learning in diagnostic processes is expected to further streamline operations and enhance the accuracy of results, thereby driving market growth.