Advancements in Robotics and Automation

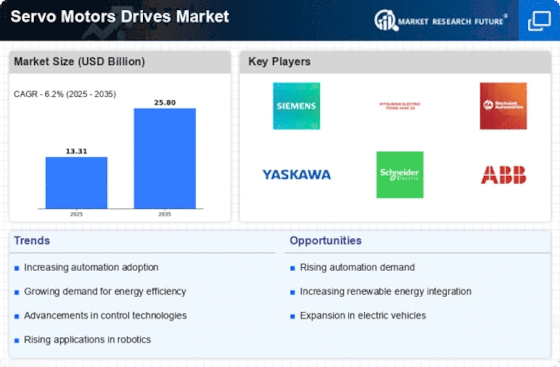

The Servo Motors Drives Market is significantly influenced by advancements in robotics and automation technologies. As industries seek to enhance productivity and efficiency, the integration of servo motors in robotic systems has become increasingly prevalent. These motors provide the necessary torque and speed control required for complex robotic movements. The robotics market is anticipated to expand at a CAGR of around 10% in the coming years, which directly correlates with the demand for servo drives. This growth is indicative of a broader trend towards automation, where servo motors play a crucial role in enabling sophisticated robotic applications, thus driving the Servo Motors Drives Market forward.

Rising Demand for Precision Engineering

The Servo Motors Drives Market is experiencing a notable surge in demand for precision engineering across various sectors. Industries such as aerospace, automotive, and manufacturing are increasingly adopting servo motors for their ability to provide high accuracy and repeatability in motion control applications. This trend is driven by the need for enhanced product quality and reduced operational costs. According to recent data, the precision engineering sector is projected to grow at a compound annual growth rate of approximately 7% over the next five years. As companies strive to improve their manufacturing processes, the integration of servo motors becomes essential, thereby propelling the growth of the Servo Motors Drives Market.

Expansion of Electric Vehicle Production

The Servo Motors Drives Market is significantly impacted by the expansion of electric vehicle (EV) production. As automakers increasingly shift towards electric mobility, the demand for high-performance servo motors in EV manufacturing processes is rising. These motors are essential for applications such as battery assembly and precision control in electric drivetrains. Recent forecasts suggest that the electric vehicle market will grow at a CAGR of around 15% in the next decade, which will likely create substantial opportunities for servo motor manufacturers. This trend underscores the critical role of servo drives in supporting the evolving automotive landscape, thereby propelling the Servo Motors Drives Market.

Growing Focus on Renewable Energy Solutions

The Servo Motors Drives Market is also benefiting from the growing emphasis on renewable energy solutions. As the world shifts towards sustainable energy sources, the demand for efficient and reliable servo motors in wind turbines and solar tracking systems is on the rise. These applications require precise control and high performance, which servo motors are well-equipped to provide. Recent statistics suggest that the renewable energy sector is expected to grow by over 8% annually, creating a substantial market for servo drives. This trend not only supports environmental goals but also enhances the overall efficiency of energy systems, thereby bolstering the Servo Motors Drives Market.

Increased Investment in Smart Manufacturing

The Servo Motors Drives Market is witnessing increased investment in smart manufacturing technologies. As industries adopt Industry 4.0 principles, the integration of IoT and AI with servo motors is becoming more prevalent. This convergence allows for real-time monitoring and optimization of manufacturing processes, leading to improved efficiency and reduced downtime. Data indicates that the smart manufacturing market is projected to grow at a CAGR of approximately 9% over the next several years. This growth is likely to drive demand for advanced servo drives that can seamlessly integrate with smart systems, thereby enhancing the Servo Motors Drives Market.