Emergence of Edge Computing

The rise of edge computing is reshaping the Server Microprocessor Market by driving the need for localized data processing. As organizations seek to reduce latency and improve response times, microprocessors designed for edge devices are becoming increasingly vital. This trend is supported by the growing number of Internet of Things (IoT) devices, which require efficient processing capabilities at the edge of the network. Market analysis indicates that the edge computing market is expected to witness substantial growth, with investments in edge infrastructure reaching billions of dollars. This shift towards edge computing compels microprocessor manufacturers to innovate and create specialized solutions that cater to the unique demands of edge applications, thereby influencing the overall dynamics of the Server Microprocessor Market.

Rising Importance of Cybersecurity

In the current digital landscape, the rising importance of cybersecurity is becoming a critical driver for the Server Microprocessor Market. As cyber threats continue to evolve, organizations are increasingly prioritizing security features in their server architectures. This trend necessitates the integration of advanced security capabilities within microprocessors, such as hardware-based encryption and secure boot processes. Market Research Future indicates that the cybersecurity market is expected to grow significantly, with organizations investing heavily in protective measures. Consequently, microprocessor manufacturers are compelled to innovate and incorporate robust security features into their products, ensuring that they meet the stringent security requirements of modern data centers. This focus on cybersecurity is likely to have a profound impact on the design and functionality of microprocessors within the Server Microprocessor Market.

Advancements in Data Center Technologies

The Server Microprocessor Market is significantly influenced by advancements in data center technologies. As organizations strive to enhance their data center efficiency and performance, there is a growing emphasis on deploying high-performance microprocessors that can support advanced workloads. Innovations such as hyper-converged infrastructure and software-defined networking are driving the demand for microprocessors that can seamlessly integrate with these technologies. Recent statistics suggest that the data center market is projected to grow at a rate of approximately 15% annually, further fueling the need for cutting-edge microprocessors. This trend compels manufacturers to focus on developing microprocessors that not only deliver superior performance but also offer enhanced reliability and scalability, thereby shaping the future landscape of the Server Microprocessor Market.

Shift Towards Sustainable Computing Solutions

The Server Microprocessor Market is witnessing a shift towards sustainable computing solutions as environmental concerns gain prominence. Organizations are increasingly seeking microprocessors that not only deliver high performance but also adhere to sustainability standards. This trend is driven by regulatory pressures and a growing awareness of the environmental impact of technology. Recent data suggests that the market for energy-efficient microprocessors is expected to expand significantly, as companies aim to reduce their carbon footprints. Manufacturers are responding by developing microprocessors that utilize advanced materials and energy-saving technologies, thereby aligning with the sustainability goals of their clients. This shift towards sustainable computing is likely to reshape the competitive landscape of the Server Microprocessor Market, as companies that prioritize eco-friendly solutions may gain a competitive edge.

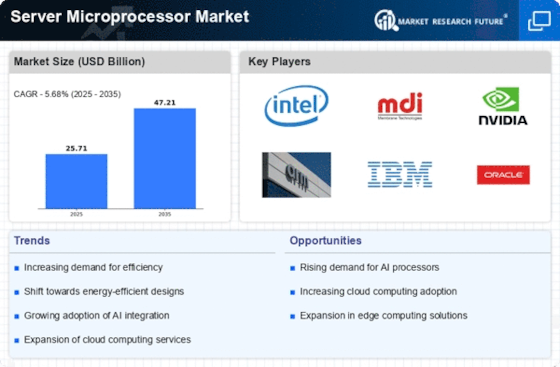

Increasing Demand for Cloud Computing Services

The Server Microprocessor Market is experiencing a notable surge in demand due to the rapid expansion of cloud computing services. As businesses increasingly migrate their operations to the cloud, the need for robust server microprocessors that can handle extensive data processing and storage requirements becomes paramount. According to recent data, the cloud computing sector is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth necessitates advanced microprocessors that can support virtualization, scalability, and high-performance computing. Consequently, manufacturers are focusing on developing microprocessors that not only enhance performance but also optimize energy consumption, thereby addressing the dual challenges of efficiency and power management in the Server Microprocessor Market.