Rise of Cloud Computing Services

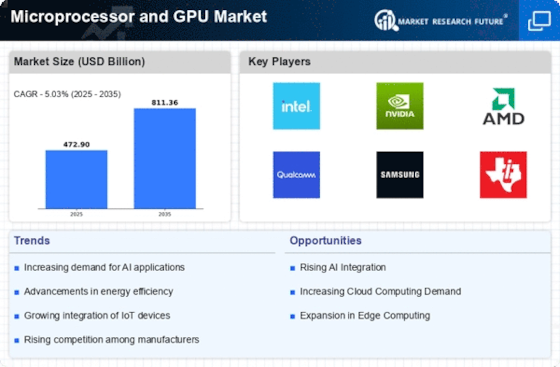

The Microprocessor and GPU Market is significantly impacted by the rise of cloud computing services. As businesses increasingly migrate to cloud-based solutions, the demand for powerful microprocessors and GPUs to support these services is on the rise. Cloud service providers are investing in high-performance computing resources to deliver scalable and efficient services to their clients. The cloud computing market is expected to grow at a compound annual growth rate of over 15%, indicating a robust demand for the underlying hardware, including microprocessors and GPUs. This trend is likely to drive innovation in the industry, as manufacturers strive to create solutions that can handle the computational demands of cloud applications, thereby enhancing overall performance and user experience.

Advancements in Semiconductor Technology

The Microprocessor and GPU Market is poised for transformation due to ongoing advancements in semiconductor technology. Innovations such as 7nm and 5nm fabrication processes are enabling the production of more powerful and energy-efficient microprocessors and GPUs. These advancements are crucial as they allow for increased transistor density, which translates to improved performance and reduced power consumption. The semiconductor industry is projected to grow at a rate of approximately 5% annually, driven by the demand for smaller, faster, and more efficient chips. As a result, manufacturers are investing heavily in research and development to leverage these technological advancements, thereby enhancing their product offerings in the microprocessor and GPU market.

Emergence of Internet of Things (IoT) Devices

The Microprocessor and GPU Market is witnessing a notable shift due to the emergence of Internet of Things (IoT) devices. As IoT technology continues to proliferate across various sectors, the demand for microprocessors and GPUs that can efficiently process data from numerous connected devices is increasing. The IoT market is projected to reach a valuation of over 1 trillion dollars by 2025, which highlights the critical role of microprocessors and GPUs in enabling smart devices to function effectively. Manufacturers are focusing on developing specialized chips that cater to the unique requirements of IoT applications, such as low power consumption and real-time data processing. This trend not only drives growth in the microprocessor and GPU market but also fosters innovation in the design and functionality of these essential components.

Expansion of Gaming and Entertainment Sectors

The Microprocessor and GPU Market is significantly influenced by the expansion of the gaming and entertainment sectors. With the rise of immersive technologies such as virtual reality and augmented reality, there is a growing need for advanced graphics processing capabilities. The gaming industry alone is projected to reach a market value exceeding 200 billion dollars by 2025, which underscores the critical role of high-performance GPUs in delivering enhanced gaming experiences. Furthermore, the increasing popularity of eSports and online streaming platforms necessitates the development of microprocessors and GPUs that can support high-resolution graphics and real-time rendering. This trend not only drives innovation within the industry but also encourages competition among manufacturers to produce cutting-edge solutions that cater to the evolving preferences of consumers.

Increasing Demand for High-Performance Computing

The Microprocessor and GPU Market is experiencing a surge in demand for high-performance computing solutions. This demand is primarily driven by advancements in data analytics, artificial intelligence, and machine learning applications. As organizations increasingly rely on data-driven decision-making, the need for powerful microprocessors and GPUs becomes paramount. According to recent estimates, the market for high-performance computing is projected to grow at a compound annual growth rate of over 7% through the next few years. This growth is indicative of the broader trend towards more sophisticated computing capabilities, which are essential for processing large datasets and executing complex algorithms. Consequently, manufacturers are focusing on developing more efficient and powerful microprocessors and GPUs to meet this escalating demand.