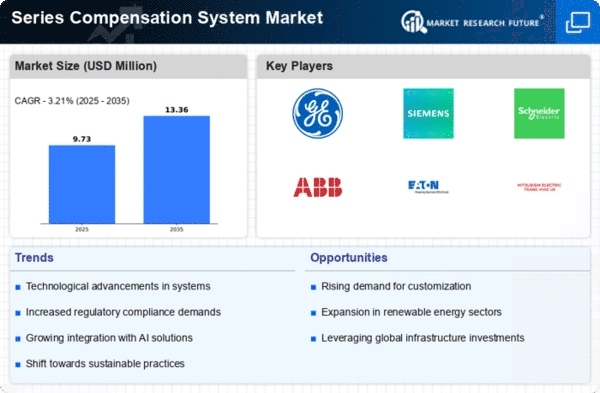

Market Growth Projections

The Global Series Compensation System Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 204.5 USD Million in 2024 and expand significantly to 850.9 USD Million by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 13.84% from 2025 to 2035. The increasing adoption of advanced compensation management systems across various sectors is likely to drive this expansion. Organizations are recognizing the need for innovative solutions to enhance employee engagement and ensure compliance with regulatory standards. This upward trend in market growth underscores the evolving landscape of compensation management on a global scale.

Globalization of Workforce

The globalization of the workforce is reshaping the Global Series Compensation System Market Industry, as companies expand their operations across borders. This trend necessitates the development of compensation strategies that accommodate diverse labor markets and cultural expectations. Organizations are increasingly adopting global compensation frameworks to ensure equity and competitiveness in their offerings. As businesses navigate the complexities of international compensation, the demand for tailored solutions is expected to rise. This shift indicates a growing recognition of the importance of aligning compensation practices with global standards, thereby driving the expansion of the Global Series Compensation System Market.

Regulatory Compliance and Transparency

Regulatory compliance is a significant driver for the Global Series Compensation System Market Industry, as organizations strive to adhere to evolving labor laws and compensation regulations. Governments worldwide are implementing stricter guidelines to ensure fair pay practices, which necessitates the adoption of comprehensive compensation systems. Companies are investing in solutions that enhance transparency and facilitate compliance with these regulations. This trend not only mitigates legal risks but also fosters trust among employees. As organizations prioritize compliance, the demand for sophisticated compensation management systems is likely to increase, further contributing to the growth trajectory of the Global Series Compensation System Market.

Focus on Performance-Based Compensation

The emphasis on performance-based compensation is a key driver in the Global Series Compensation System Market Industry. Organizations are increasingly shifting away from traditional salary structures towards performance-linked pay models that reward employees based on their contributions. This approach not only motivates employees but also aligns their goals with organizational objectives. As companies adopt these models, the demand for sophisticated compensation management systems that can effectively track and analyze performance metrics is likely to increase. This trend suggests a transformative shift in compensation strategies, further propelling the growth of the Global Series Compensation System Market.

Increasing Demand for Employee Engagement

The Global Series Compensation System Market Industry experiences a notable surge in demand driven by the need for enhanced employee engagement. Organizations are increasingly recognizing that competitive compensation packages are essential for attracting and retaining top talent. In 2024, the market is projected to reach 204.5 USD Million, reflecting a growing investment in comprehensive compensation systems that align with employee expectations. Companies are adopting innovative compensation strategies, including performance-based incentives and flexible benefits, to foster a motivated workforce. This trend suggests that businesses are prioritizing employee satisfaction as a critical component of their overall strategy, thereby propelling the growth of the Global Series Compensation System Market.

Technological Advancements in Compensation Management

Technological innovations play a pivotal role in shaping the Global Series Compensation System Market Industry. The integration of advanced analytics and artificial intelligence into compensation management systems enables organizations to make data-driven decisions regarding employee remuneration. These technologies facilitate real-time analysis of compensation trends, ensuring that companies remain competitive in their offerings. As organizations increasingly adopt these sophisticated tools, the market is expected to witness substantial growth. By 2035, the market could expand to 850.9 USD Million, indicating a robust CAGR of 13.84% from 2025 to 2035. This evolution underscores the importance of technology in optimizing compensation strategies and enhancing overall organizational performance.