Need for Cost Reduction

Cost reduction remains a pivotal driver in the Self Organizing Network Market. Telecommunications operators are under constant pressure to minimize expenses while maintaining service quality. The integration of SON technologies offers a viable solution, as these systems automate various network management tasks, reducing the need for manual intervention. Studies suggest that operators can achieve up to 25% savings in operational expenditures through the adoption of self-organizing networks. This financial incentive is compelling, particularly in a landscape where margins are increasingly thin. As companies seek to streamline operations and enhance profitability, the demand for SON solutions is expected to grow, further solidifying their role in the telecommunications sector.

Rising Mobile Data Traffic

The Self Organizing Network Market is significantly influenced by the rising mobile data traffic. With the proliferation of smartphones and mobile applications, data consumption has escalated dramatically. Reports indicate that mobile data traffic is expected to increase by over 50% annually. This surge necessitates the deployment of advanced network management solutions, such as self-organizing networks, to handle the increased load effectively. SON technologies enable dynamic resource allocation and load balancing, ensuring that networks can adapt to fluctuating demands. As mobile operators strive to provide seamless connectivity amidst this growing traffic, the adoption of SON solutions is likely to accelerate, positioning them as a critical component in modern telecommunications infrastructure.

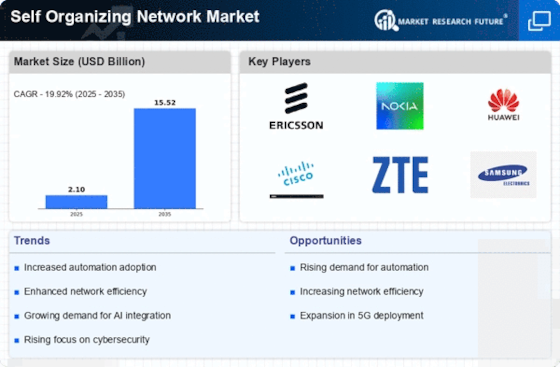

Enhanced Network Efficiency

The Self Organizing Network Market is witnessing a surge in demand for enhanced network efficiency. As telecommunications networks become increasingly complex, the need for automated solutions that optimize performance is paramount. Self-organizing networks (SON) facilitate real-time adjustments to network parameters, thereby improving overall efficiency. According to recent data, the implementation of SON technologies can lead to a reduction in operational costs by up to 30%. This efficiency not only benefits service providers but also enhances user experience, as customers enjoy more reliable and faster connectivity. The growing emphasis on network efficiency is likely to drive investments in SON solutions, as operators seek to maintain competitive advantages in a saturated market.

Advancements in 5G Technology

The Self Organizing Network Market is poised for growth due to advancements in 5G technology. The rollout of 5G networks necessitates the implementation of self-organizing capabilities to manage the increased complexity and density of these networks. With 5G expected to support a vast number of connected devices and applications, SON technologies will play a crucial role in ensuring optimal performance and reliability. Industry forecasts indicate that the 5G market could reach a valuation of over 700 billion dollars by 2026, driving demand for innovative network management solutions. As operators invest in 5G infrastructure, the integration of self-organizing networks will likely become a standard practice, further propelling the market forward.

Increased Focus on Network Security

The Self Organizing Network Market is increasingly shaped by the heightened focus on network security. As cyber threats evolve, telecommunications providers are compelled to adopt more sophisticated security measures. Self-organizing networks can enhance security protocols by enabling real-time monitoring and automated responses to potential threats. This proactive approach to security is essential in safeguarding sensitive data and maintaining customer trust. Furthermore, the integration of SON technologies can facilitate compliance with regulatory requirements, which is becoming more stringent across various regions. As security concerns continue to mount, the adoption of self-organizing networks is likely to gain traction, positioning them as a critical element in the telecommunications landscape.