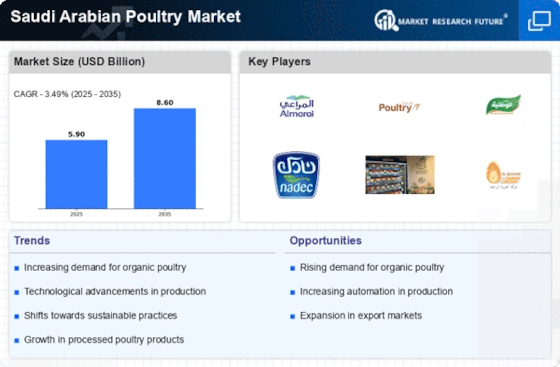

Rising Export Opportunities

The Saudi Arabian Poultry Market is poised to capitalize on rising export opportunities, particularly in neighboring regions. As the quality of locally produced poultry continues to improve, there is a growing interest from international markets. In 2025, exports are projected to account for approximately 15% of total production, reflecting the industry's potential to expand its footprint beyond domestic borders. This trend is supported by trade agreements and partnerships that facilitate access to new markets. The increasing The Saudi Arabian Poultry Industry, positioning it as a competitive player in the international arena.

Consumer Preference for Halal Products

The Saudi Arabian Poultry Market is significantly influenced by consumer preference for halal products. As a predominantly Muslim country, the demand for halal-certified poultry is inherently high, driving producers to adhere to strict halal standards. This preference not only shapes the local market dynamics but also opens avenues for export to other regions with substantial Muslim populations. In 2025, it is estimated that halal poultry products will constitute over 90% of the total poultry market, underscoring the importance of compliance with halal regulations. This consumer inclination is likely to reinforce the growth trajectory of the Saudi Arabian Poultry Market, as producers align their offerings with market expectations.

Increasing Demand for Poultry Products

The Saudi Arabian Poultry Market is experiencing a notable surge in demand for poultry products, driven by a growing population and changing dietary preferences. As the population continues to expand, the per capita consumption of poultry is projected to rise, reflecting a shift towards protein-rich diets. In 2025, the demand for chicken meat is expected to reach approximately 1.5 million tons, indicating a robust growth trajectory. This increasing demand is further fueled by the rising awareness of the nutritional benefits associated with poultry consumption, positioning the Saudi Arabian Poultry Market for sustained growth in the coming years.

Investment in Modern Farming Techniques

The Saudi Arabian Poultry Market is witnessing a significant transformation due to investments in modern farming techniques. The adoption of advanced technologies, such as automated feeding systems and climate control, enhances production efficiency and animal welfare. In recent years, the industry has seen a shift towards integrated poultry production systems, which streamline operations and reduce costs. This modernization is expected to increase overall production capacity, with estimates suggesting that the industry could produce over 1.8 million tons of poultry by 2026. Such advancements not only improve productivity but also contribute to the sustainability of the Saudi Arabian Poultry Market.

Government Initiatives for Food Security

The Saudi Arabian Poultry Market benefits from proactive government initiatives aimed at enhancing food security. The government has implemented various policies to support local poultry production, including subsidies and financial incentives for farmers. These measures are designed to reduce dependency on imports and ensure a stable supply of poultry products. In 2025, the government aims to increase local production to meet 70% of the national demand, thereby bolstering the resilience of the Saudi Arabian Poultry Market. Such initiatives are likely to foster a more self-sufficient poultry sector, contributing to the overall economic stability of the region.