Energy Sector Expansion

The expansion of the energy sector in Russia serves as a crucial driver for the reciprocating compressor market. With the country being one of the largest producers of oil and natural gas, the demand for compressors in this sector is substantial. The energy sector's growth is projected to increase by approximately 4% annually, leading to heightened requirements for efficient gas compression solutions. Reciprocating compressors play a vital role in various applications, including gas processing and transportation, making them indispensable for energy companies. Additionally, the push towards enhancing energy efficiency and reducing emissions aligns with the capabilities of modern reciprocating compressors, which are designed to operate at optimal performance levels. This alignment suggests that the reciprocating compressor market will continue to thrive as energy companies seek to modernize their operations and meet regulatory standards.

Rising Demand from the Manufacturing Sector

The manufacturing sector in Russia is experiencing a resurgence, which is a key driver for the reciprocating compressor market. As production activities ramp up, the need for reliable and efficient compressors becomes paramount. The sector is projected to grow at a rate of approximately 3% annually, with significant investments in machinery and equipment. Reciprocating compressors are essential for various manufacturing processes, including pneumatic conveying, material handling, and process cooling. This increasing demand is likely to encourage manufacturers to innovate and enhance their product offerings to cater to the specific needs of the manufacturing industry. Furthermore, as companies strive to improve productivity and reduce operational costs, the adoption of advanced compressor technologies is expected to rise, thereby bolstering the growth of the reciprocating compressor market.

Technological Innovations in Compressor Design

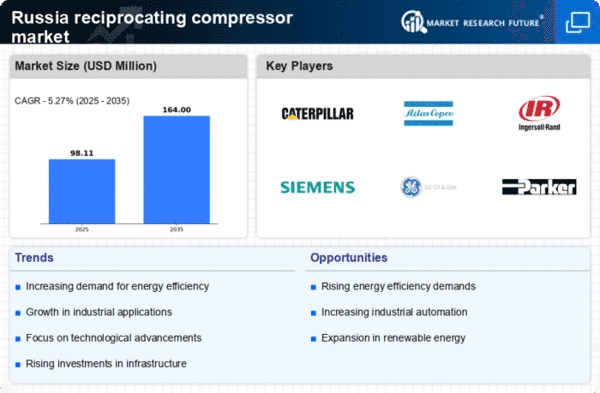

Technological innovations in compressor design are significantly influencing the reciprocating compressor market. Advances in materials and engineering techniques have led to the development of more efficient and durable compressors. For instance, the introduction of advanced sealing technologies and improved lubrication systems has enhanced the reliability and performance of reciprocating compressors. This trend is particularly relevant in Russia, where industries are increasingly adopting state-of-the-art equipment to optimize production processes. The market is expected to witness a compound annual growth rate (CAGR) of around 5% over the next five years, driven by these innovations. Furthermore, the integration of smart technologies, such as IoT and predictive maintenance, is likely to revolutionize the operational capabilities of reciprocating compressors, making them more attractive to end-users in various sectors.

Industrial Growth and Infrastructure Development

The ongoing industrial growth in Russia is a pivotal driver for the reciprocating compressor market. As the country invests heavily in infrastructure projects, the demand for efficient and reliable compressors is expected to rise. The construction and manufacturing sectors are particularly influential, with significant investments projected to reach approximately $100 billion by 2026. This surge in industrial activity necessitates advanced compressor systems to support various applications, including refrigeration, air conditioning, and gas compression. Consequently, the reciprocating compressor market is likely to benefit from this trend, as industries seek to enhance operational efficiency and reduce energy consumption. Furthermore, the government's initiatives to modernize existing facilities and promote new industrial zones are anticipated to further stimulate market growth, creating a favorable environment for manufacturers and suppliers in the reciprocating compressor market.

Regulatory Compliance and Environmental Standards

Regulatory compliance and environmental standards are becoming increasingly stringent in Russia, driving the demand for advanced reciprocating compressors. Industries are required to adhere to regulations aimed at reducing emissions and improving energy efficiency. This regulatory landscape compels companies to invest in modern compressor technologies that meet these standards. The reciprocating compressor market is likely to see a surge in demand as businesses seek to upgrade their equipment to comply with environmental regulations. Additionally, the government's commitment to sustainability initiatives further emphasizes the need for efficient and eco-friendly compressor solutions. As a result, manufacturers in the reciprocating compressor market are expected to focus on developing products that not only meet regulatory requirements but also enhance operational efficiency, thereby positioning themselves favorably in a competitive market.