Russia Oil & Gas Projects Market

Russia Oil and Gas Projects Market Russia Oil and Gas Projects Market Research Report: By Type (Surface and Lease Equipment, Gathering & Processing, Oil, Gas & NGL Pipelines, Oil & Gas Storage, Refining & Oil Products Transport and Export Terminals) andBy Drilling (Offshore, Onshore)- Forecast to 2035

Russia Oil and Gas Projects Market Overview:

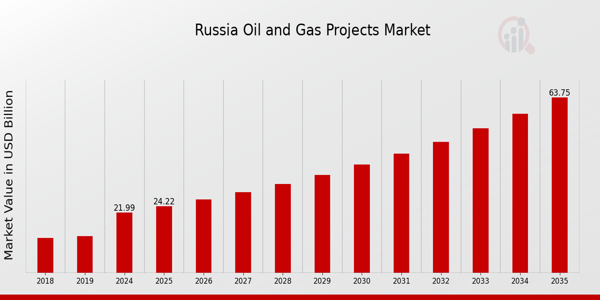

As per MRFR analysis, the Russia Oil and Gas Projects Market Size was estimated at 20.81 (USD Billion) in 2023.The Russia Oil and Gas Projects Market is expected to grow from 21.99(USD Billion) in 2024 to 63.75 (USD Billion) by 2035. The Russia Oil and Gas Projects Market CAGR (growth rate) is expected to be around 10.16% during the forecast period (2025 - 2035).

Key Russia Oil and Gas Projects Market Trends Highlighted

Both domestic and international causes are causing major changes in the Russia Oil and Gas Projects Market. The growing need for energy, especially natural gas, from European and Asian nations is one of the main factors propelling the industry.

Since Russia is one of the biggest producers and exporters of natural gas, it is nevertheless imperative that infrastructure like pipelines and storage facilities be developed. The industry is also being shaped by the government's focus on improving energy efficiency and exploring cutting-edge technology in oil extraction.

Exploring undiscovered treasures in Arctic locations has been increasingly popular in recent years, offering special prospects. These initiatives are becoming more viable as cold weather operational technology progress.

Additionally, within the framework of oil and gas, investments in cleaner extraction techniques and renewable energy sources are being propelled by the change towards sustainable practices and environmental considerations.

Additionally, there are chances to strengthen domestic production capacities and lessen reliance on imported technologies. The development of strategic alliances with domestic companies promotes industry expansion and increases competition.

It is becoming more widely accepted that integrating digital technologies like artificial intelligence and big data analytics is essential to improve safety standards and streamlining operations in uncertain situations.

All things considered, the Russian oil and gas industry is evolving, seizing chances to adjust to shifting geopolitical environments and energy needs while simultaneously following worldwide trends toward sustainability and technical advancement.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Russia Oil and Gas Projects Market Drivers

Increased Energy Demand in Russia

The surging energy demand within Russia is one of the critical drivers for the Russia Oil and Gas Projects Market. According to the Russian Ministry of Energy, domestic energy consumption has seen consistent growth, with forecasts indicating that natural gas demand could increase by approximately 1.3% annually over the next decade.

This increase is supported by the country's aim to enhance energy security and diversify its energy supply sources. Major oil and gas companies, such as Gazprom and Rosneft, are responding to this heightened demand through investments in infrastructure and exploration projects across Siberia and the Arctic regions.

Moreover, the Russian government has highlighted initiatives to expand energy exports, which will further bolster the oil and gas projects market by attracting foreign investment and facilitating technological innovations in the sector.

Government Policies Supporting Oil and Gas Industry

The Russian government has implemented various policies that support the oil and gas sector, driving growth in the Russia Oil and Gas Projects Market. For instance, in recent years, policies aimed at enhancing the investment climate, such as tax incentives for exploratory drilling and production activities in difficult-to-reach areas, have been introduced.

The Federal Law on Subsoil Resources has further clarified regulations and reduced barriers for foreign investors. In 2020, the Ministry of Natural Resources reported an increase in the number of licenses issued for oil exploration and production as a direct outcome of these supportive regulations.

Such initiatives ensure the longevity and sustainability of the industry while promoting technological advancements in extraction processes.

Technological Advancements in Exploration and Production

Technological innovations are playing a significant role in the advancement of the Russia Oil and Gas Projects Market. With the increase in Research and Development (R&D) investment, Russian companies are adopting advanced technologies in exploration and production processes.

For example, improved seismic imaging and horizontal drilling technologies have enhanced the extraction process from existing fields, making previously non-viable reserves economically feasible.

According to data from the Russian Ministry of Energy, the usage of such technologies has led to a 15% increase in production efficiency over the past five years. Companies like Lukoil and Surgutneftegas are at the forefront of these developments, integrating new technologies that streamline operations while minimizing environmental impacts.

Investment in Infrastructure Development

Infrastructure development plays a pivotal role in the growth of the Russia Oil and Gas Projects Market. Significant investments in pipelines, refineries, and transportation networks are crucial for effectively linking production sites to markets.

According to the Russian federal government, there are ongoing projects to expand the Power of Siberia gas pipeline, which aims to transport natural gas to China, thereby enhancing Russia's position as a key energy supplier in Asia.

The expansion is expected to require investments exceeding USD 55 billion by the completion date. This infrastructural growth creates opportunities for various stakeholders in the oil and gas sector, driving capital flow and fostering jobs in local communities.

Russia Oil and Gas Projects Market Segment Insights:

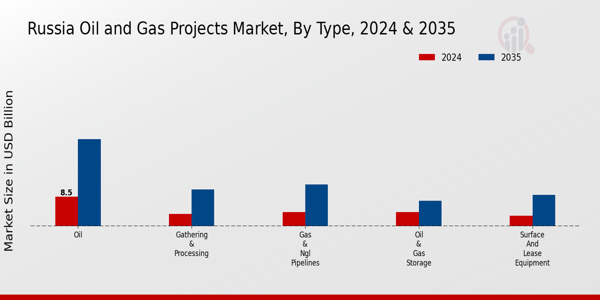

Oil and Gas Projects Market Type Insights

The Russia Oil and Gas Projects Market is a crucial sector that plays a significant role in the nation’s economy and energy strategy. As the largest country in the world, Russia possesses abundant natural resources, making its oil and gas industry crucial for both domestic energy needs and export revenues.

Within the overall market, various types of projects such as Surface and Lease Equipment, Gathering and Processing, Oil, Gas and NGL Pipelines, Oil and Gas Storage, Refining and Oil Products Transport, and Export Terminals shape the landscape of energy production and distribution in the region.

Surface and Lease Equipment projects are of particular importance as they directly impact the efficiency of extraction processes, ensuring that operational challenges are minimized, thus maintaining a steady supply into the market.

Gathering and Processing infrastructure is essential for the initial extraction and preparation of hydrocarbons before they are transported. The vast network of Oil, Gas and NGL Pipelines in Russia not only supports internal distribution but also enhances the country's capability to export energy resources to various global markets, reflecting Russia's pivotal role in global energy dynamics.

Furthermore, Oil and Gas Storage facilities provide strategic reserves that ensure supply stability, especially during fluctuations in demand or geopolitical tensions. Refining and Oil Products Transport are critical as they convert raw materials into usable products, thus contributing to energy security and economic stability.

Finally, Export Terminals support the logistics of sending Russia’s energy resources worldwide, significantly impacting trade balances and fostering international economic relationships.

In the context of this market environment, government initiatives to modernize infrastructure and embrace newer technologies are continuously evolving, potentially leading to increased efficiency and production capabilities. As awareness of environmental impacts grows, there are also discussions on balancing development with sustainability, adding another layer of complexity to the dynamics within the sector.

The variety of segments and their interconnections highlight the multifaceted nature of the Russia Oil and Gas Projects Market, demonstrating its essential role in supporting the nation's economy while navigating the challenges and opportunities present in a changing global landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Oil and Gas Projects Market Drilling Insights

The Drilling segment within the Russia Oil and Gas Projects Market is pivotal to the country’s energy landscape, particularly given Russia's substantial reserves and production capacity. The market is characterized by two primary categories: Offshore and Onshore drilling.

Offshore drilling plays a crucial role due to Russia's vast seabed resources in regions such as the Arctic and the Caspian Sea, where significant reserves are accessible. Conversely, onshore drilling dominates the market due to the extensive presence of oil and gas fields across vast terrestrial areas, facilitating easier access and infrastructure development.

This segment is bolstered by technological advancements, improved extraction techniques, and the growing focus on enhancing efficiency and safety in drilling operations. Additionally, the government's policies aimed at sustaining and boosting production levels create a favorable environment for investments in drilling activities.

Challenges such as environmental concerns, regulatory requirements, and geopolitical factors can impact operations, yet the ongoing demand for energy continues to present opportunities for growth in this segment. As the sector evolves, the balance between offshore innovation and onshore efficiency will shape the future dynamics of drilling in the Russia Oil and Gas Projects Market.

Russia Oil and Gas Projects Market Key Players and Competitive Insights:

The Russia Oil and Gas Projects Market is characterized by intense competition, with numerous national and international players vying for dominance in this energy-rich landscape. The market's competitive dynamics are shaped by several factors including resource availability, technological advancements, and regulatory frameworks that govern exploration and production activities.

As global energy demands fluctuate and sustainability concerns rise, companies within this market are compelled to innovate continually and integrate environmentally friendly practices.

This ever-evolving sector is also influenced by geopolitical elements and the international stance on energy dependence, leading to a complex tapestry within which companies must navigate to achieve competitive advantage and market leadership.

Novatek has positioned itself as a significant player in the Russia Oil and Gas Projects Market, leveraging its extensive gas reserves and strategic partnerships. The company focuses predominantly on natural gas production and emphasizes the importance of liquefied natural gas (LNG) projects that cater to both domestic and international markets.

Novatek's strengths lie in its innovative technologies aimed at enhancing production efficiency and reducing costs, which have propelled its growth trajectory in a competitive environment. Furthermore, the company's strong financial backing, coupled with a robust infrastructure network, facilitates seamless operations across different phases of oil and gas project development.

Its adept management of resources ensures that Novatek remains pivotal in steering Russia’s energy initiatives forward, capitalizing on the country’s vast reserves while maintaining a competitive edge in the industry.

Severneft, another crucial entity in the Russia Oil and Gas Projects Market, has carved out a niche through its focus on the full oil and gas value chain, from extraction to refining and distribution. This company spans various operating segments that include crude oil production, processing infrastructure, and market distribution, all of which are strategically developed to serve the regional demands effectively.

Severneft has established a solid market presence through its commitment to high-quality production standards, innovative operational strategies, and a network of partnerships aimed at expanding its reach within Russia’s vast energy landscape. The company's strengths are further highlighted by its advanced technology utilization that enhances operational efficiency and minimizes environmental impact.

Over recent years, Severneft has engaged in various mergers and acquisitions that strengthen its competitive standing, enabling it to consolidate assets and expand its geographic footprint, ensuring a robust position in one of the world's most critical oil and gas markets.

Key Companies in the Russia Oil and Gas Projects Market Include:

Novatek

Severneft

Surgutneftegas

Tatneft

Rosneft

Gazprom Neft

Oil and Gas Corporation

Yamal LNG

Russneft

Gazprom

Bashneft

Alrosa

Zarubezhneft

Transneft

Lukoil

Russia Oil and Gas Projects Market Developments

In recent months, the Russia Oil and Gas Projects Market has seen significant developments, particularly involving key players such as Novatek, Gazprom Neft, and Rosneft. In October 2023, Novatek announced plans to expand its LNG capacities, leveraging the Yamal LNG project’s success to capture global markets amid rising energy demands.

Additionally, Rosneft and Gazprom Neft are engaged in multiple collaboration projects to enhance oil recovery techniques across Siberian fields, aiming for sustainable production amidst climate concerns. In terms of mergers and acquisitions, in September 2023, Gazprom successfully completed the purchase of a significant stake in Alrosa, emphasizing its strategy to diversify into related sectors.

Market valuations have surged, with Gazprom witnessing a notable 15% increase in stock value due to favorable market conditions and strategic investments. Over the past two years, the introduction of new regulatory frameworks in June 2022 has encouraged foreign investments into Russia's oil sector, while geopolitical factors remain pivotal in shaping market dynamics.

Furthermore, the Russian government is investing in modernizing infrastructure, with Transneft leading initiatives to enhance pipeline efficiency, marking a transformative phase in the national oil landscape.

Russia Oil and Gas Projects Market Segmentation Insights

Oil and Gas Projects Market Type Outlook

Surface and Lease Equipment

Gathering & Processing

Oil

Gas & NGL Pipelines

Oil & Gas Storage

Refining & Oil Products Transport and Export Terminals

Oil and Gas Projects Market Drilling Outlook

Offshore

Onshore

FAQs

What is the expected market size of the Russia Oil and Gas Projects Market in 2024?

The Russia Oil and Gas Projects Market is expected to be valued at 21.99 USD Billion in 2024.

What is the projected market size for the Russia Oil and Gas Projects Market by 2035?

By 2035, the overall market size is anticipated to reach 63.75 USD Billion.

What is the compound annual growth rate (CAGR) for the Russia Oil and Gas Projects Market from 2025 to 2035?

The market is expected to witness a CAGR of 10.16% during the period from 2025 to 2035.

Which segment is expected to hold the largest market share in 2024 within the Russia Oil and Gas Projects Market?

The segment for Oil is anticipated to hold the largest market share, valued at 8.5 USD Billion in 2024.

What will be the value of the Surface and Lease Equipment segment in the Russia Oil and Gas Projects Market by 2035?

The Surface and Lease Equipment segment is projected to reach a value of 9.0 USD Billion by 2035.

What are the key players in the Russia Oil and Gas Projects Market?

Major players in the market include Novatek, Severneft, Surgutneftegas, Rosneft, and Gazprom Neft.

How much is the Oil & Gas Storage segment expected to be valued at in 2024?

The Oil & Gas Storage segment is expected to be valued at 3.99 USD Billion in 2024.

What opportunities and trends are driving growth in the Russia Oil and Gas Projects Market?

The market is driven by growing energy demands and advancements in extraction technologies.

How will the market size of the Gas & NGL Pipelines segment change from 2024 to 2035?

The Gas & NGL Pipelines segment is expected to grow from 4.0 USD Billion in 2024 to 12.0 USD Billion by 2035.

What challenges might the Russia Oil and Gas Projects Market face in the coming years?

The market may face challenges such as geopolitical tensions and regulatory changes impacting operations.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”