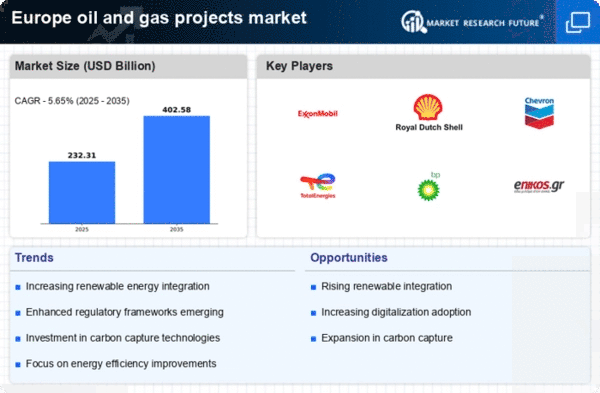

Regulatory Framework Enhancements

The oil gas-projects market in Europe is currently influenced by evolving regulatory frameworks aimed at promoting energy security and environmental sustainability. Governments are implementing stricter regulations to reduce carbon emissions, which may lead to increased operational costs for oil and gas companies. For instance, the European Union's Green Deal aims to make Europe climate-neutral by 2050, potentially impacting investment strategies within the oil gas-projects market. Compliance with these regulations could require significant capital investment, estimated at €1 trillion by 2030, thereby reshaping project feasibility and timelines. This regulatory landscape may drive innovation in cleaner technologies, influencing the overall dynamics of the oil gas-projects market in Europe.

Technological Integration for Efficiency

The integration of advanced technologies is reshaping the oil gas-projects market in Europe. Innovations such as artificial intelligence, big data analytics, and automation are being adopted to enhance operational efficiency and reduce costs. For instance, the implementation of predictive maintenance technologies can decrease downtime by up to 20%, thereby improving overall productivity. As companies strive to optimize their operations, the oil gas-projects market is likely to witness a shift towards more technologically driven projects. This trend not only enhances profitability but also aligns with the industry's goal of minimizing environmental impact, suggesting a dual benefit for stakeholders in the oil gas-projects market.

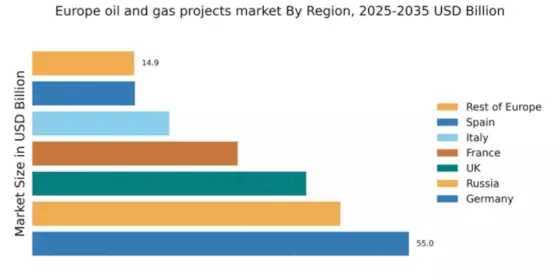

Geopolitical Tensions and Energy Security

Geopolitical tensions in various regions have a profound impact on the oil gas-projects market in Europe. The ongoing conflicts and trade disputes can disrupt supply chains, leading to volatility in oil and gas prices. For example, the reliance on imports from politically unstable regions may compel European nations to invest in domestic oil gas-projects to enhance energy security. This shift could result in a projected increase of 15% in domestic production by 2027, as countries seek to reduce dependency on foreign energy sources. Consequently, the oil gas-projects market may experience a surge in investment aimed at bolstering local production capabilities.

Investment Shifts Towards Renewable Integration

The oil gas-projects market in Europe is experiencing a notable shift in investment patterns, with a growing emphasis on integrating renewable energy sources. As the demand for cleaner energy solutions rises, traditional oil and gas companies are diversifying their portfolios to include renewable projects. This transition is expected to attract approximately €200 billion in investments by 2030, as firms seek to align with sustainability goals. The integration of renewables into existing oil gas-projects may enhance their viability and appeal, potentially leading to a more resilient energy landscape. This evolving investment strategy reflects a broader trend within the oil gas-projects market, where adaptability is becoming increasingly crucial.

Market Demand Fluctuations and Consumer Behavior

The oil gas-projects market in Europe is significantly influenced by fluctuations in market demand and changing consumer behavior. As energy consumption patterns evolve, driven by factors such as economic growth and technological advancements, the demand for oil and gas products may experience volatility. For instance, a projected increase in energy demand of 10% by 2030 could prompt a reevaluation of existing oil gas-projects. Companies may need to adapt their strategies to meet this demand, potentially leading to increased exploration and production activities. Understanding consumer preferences and market dynamics is essential for stakeholders in the oil gas-projects market to navigate these fluctuations effectively.