Rising Energy Demand

The oil gas-projects market in Canada is experiencing a notable increase in energy demand, driven by both domestic consumption and international market dynamics. As the population grows and industrial activities expand, the need for reliable energy sources intensifies. In 2025, Canada's energy consumption is projected to rise by approximately 2.5%, which could lead to increased investments in oil and gas projects. This demand surge compels companies to enhance their production capabilities, thereby stimulating growth within the oil gas-projects market. Furthermore, the transition towards cleaner energy sources may also influence the types of projects being developed, as stakeholders seek to balance traditional energy needs with sustainability goals.

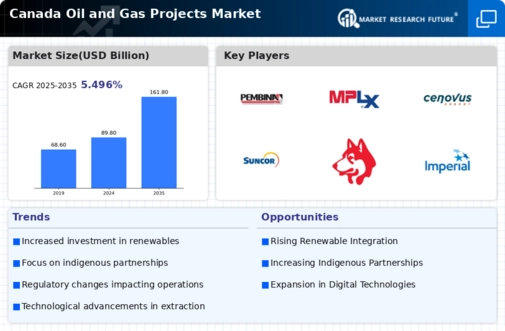

Technological Innovations in Extraction

Technological advancements in extraction methods are significantly impacting the oil gas-projects market in Canada. Innovations such as hydraulic fracturing and horizontal drilling have revolutionized the way resources are extracted, leading to increased efficiency and reduced costs. In 2025, it is estimated that these technologies could enhance production rates by up to 15%, thereby boosting the overall output of the oil gas-projects market. As companies adopt these cutting-edge techniques, they are likely to improve their competitive edge, which may result in a more dynamic market landscape. The ongoing research and development in extraction technologies suggest a promising trajectory for the industry.

Environmental Regulations and Compliance

The oil gas-projects market in Canada is increasingly influenced by stringent environmental regulations. The government has implemented various policies aimed at reducing greenhouse gas emissions and promoting sustainable practices. Compliance with these regulations often requires significant investment in cleaner technologies and processes. In 2025, it is anticipated that companies will allocate approximately 20% of their budgets to meet these environmental standards. While this may pose challenges, it also presents opportunities for innovation and improvement within the oil gas-projects market. Companies that proactively adapt to these regulations may gain a competitive advantage in an evolving regulatory landscape.

Investment in Infrastructure Development

Infrastructure development plays a crucial role in the oil gas-projects market in Canada. The government has committed to investing over $10 billion in energy infrastructure projects over the next five years, which is expected to enhance transportation and distribution networks. Improved infrastructure not only facilitates the efficient movement of oil and gas but also attracts foreign investment. Enhanced pipelines, refineries, and storage facilities are essential for meeting the growing energy demand. This investment trend indicates a robust future for the oil gas-projects market, as it lays the groundwork for increased production and operational efficiency.

Geopolitical Factors and Market Stability

Geopolitical factors play a pivotal role in shaping the oil gas-projects market in Canada. Fluctuations in global oil prices, influenced by international relations and trade agreements, can significantly impact investment decisions and project viability. In 2025, ongoing tensions in key oil-producing regions may lead to increased volatility in oil prices, which could affect the profitability of Canadian projects. Companies operating in the oil gas-projects market must remain vigilant and adaptable to these geopolitical shifts. Understanding the interplay between local and international dynamics is essential for navigating potential risks and capitalizing on opportunities in the market.