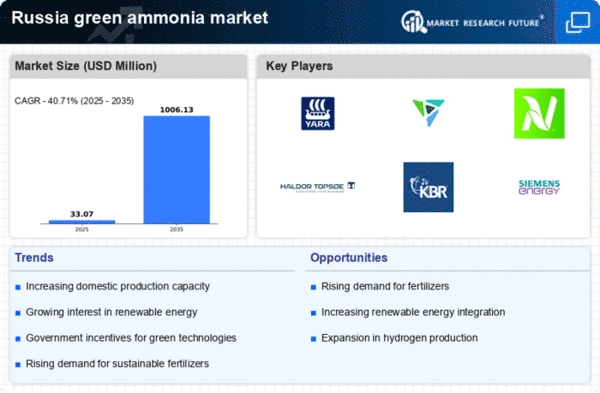

The green ammonia market in Russia is characterized by a dynamic competitive landscape. This is driven by increasing demand for sustainable energy solutions and the need for decarbonization in various industrial sectors. Key players such as Yara International (NO), CF Industries (US), and Siemens Energy (DE) are actively shaping the market through strategic initiatives focused on innovation and regional expansion. Yara International (NO) has positioned itself as a leader in sustainable agricultural solutions, leveraging its expertise in ammonia production to develop green ammonia technologies. Meanwhile, CF Industries (US) is enhancing its operational capabilities through investments in advanced production facilities, aiming to meet the growing demand for low-carbon fertilizers. Siemens Energy (DE) is also making strides by integrating digital technologies into its ammonia production processes, thereby improving efficiency and reducing emissions.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains, which are crucial in a moderately fragmented market. The collective influence of these key players is evident in their ability to drive innovation and establish partnerships that enhance their competitive positioning. As the market evolves, the focus on sustainability and technological advancement is likely to intensify, further shaping the competitive structure.

In October Yara International (NO) announced a partnership with a leading Russian energy company to develop a green ammonia production facility in Siberia. This strategic move is significant as it not only expands Yara's operational footprint in Russia but also aligns with the country's ambitions to become a major player in the green energy sector. The facility is expected to utilize renewable energy sources, thereby reducing the carbon footprint associated with traditional ammonia production.

In September Siemens Energy (DE) unveiled a new digital platform aimed at optimizing ammonia production processes. This initiative is particularly noteworthy as it integrates artificial intelligence and machine learning to enhance operational efficiency. By leveraging these technologies, Siemens Energy (DE) aims to reduce production costs and improve the sustainability of its operations, positioning itself as a frontrunner in the green ammonia market.

In August CF Industries (US) completed the acquisition of a local ammonia production facility in Russia, which is expected to bolster its supply chain capabilities. This acquisition is strategically important as it allows CF Industries (US) to enhance its production capacity and better serve the growing demand for green ammonia in the region. The integration of this facility into its operations is likely to provide a competitive edge in terms of responsiveness and cost efficiency.

As of November the competitive trends in the green ammonia market are increasingly defined by digitalization, sustainability, and strategic alliances. Companies are recognizing the importance of collaboration to drive innovation and enhance their market positions. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming more pronounced. Looking ahead, competitive differentiation will likely hinge on the ability to innovate and adapt to evolving market demands, with a strong emphasis on sustainable practices and advanced technologies.