Supportive Regulatory Frameworks

The North America Green Ammonia Market benefits from a supportive regulatory environment that encourages the adoption of green technologies. Various federal and state-level policies are being implemented to promote the production and use of green ammonia. For instance, the U.S. Department of Energy has initiated programs aimed at advancing hydrogen and ammonia technologies, which are crucial for the development of a sustainable energy infrastructure. Additionally, tax incentives and grants are available for companies investing in green ammonia production facilities. This regulatory support is expected to catalyze investments in the North America Green Ammonia Market, potentially leading to a market size of over 2 million metric tons by 2027. Such frameworks not only enhance market viability but also foster innovation in production processes.

Rising Demand for Renewable Energy Sources

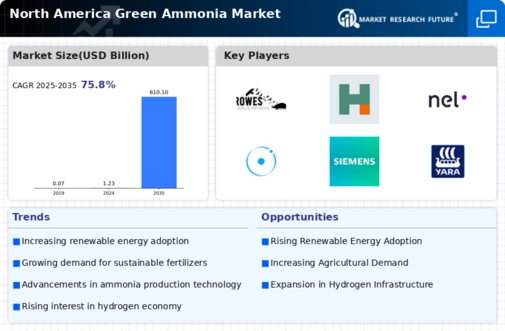

The North America Green Ammonia Market is experiencing a notable surge in demand for renewable energy sources. This trend is largely driven by the increasing awareness of climate change and the need for sustainable energy solutions. Green ammonia, produced through renewable energy, serves as a potential energy carrier and storage medium. In 2025, the market for green ammonia in North America was projected to reach approximately 1.5 million metric tons, reflecting a compound annual growth rate of around 20%. This growth is indicative of a broader shift towards decarbonization in the energy sector, as industries seek to reduce their carbon footprints. The North America Green Ammonia Market is thus positioned to play a pivotal role in the transition to a more sustainable energy landscape.

Technological Innovations in Production Processes

Technological advancements are playing a crucial role in shaping the North America Green Ammonia Market. Innovations in production processes, such as electrolysis and Haber-Bosch methods, are enhancing the efficiency and cost-effectiveness of green ammonia production. Companies are investing in research and development to optimize these technologies, which could lead to a reduction in production costs by up to 30% by 2028. Furthermore, the integration of renewable energy sources, such as wind and solar, into ammonia production is becoming more prevalent. This technological evolution is expected to bolster the North America Green Ammonia Market, potentially increasing production capacity to 3 million metric tons by 2029. As these technologies mature, they may also attract further investments and partnerships within the industry.

Increasing Investment in Green Hydrogen Initiatives

The North America Green Ammonia Market is poised to benefit from the rising investment in green hydrogen initiatives. Green ammonia is often viewed as a key component in the hydrogen economy, serving as a transportable form of hydrogen. In 2025, investments in green hydrogen projects in North America were projected to exceed $5 billion, with a significant portion allocated to ammonia production facilities. This influx of capital is likely to accelerate the development of infrastructure necessary for green ammonia production and distribution. As companies and governments collaborate on hydrogen initiatives, the North America Green Ammonia Market could see substantial growth, potentially reaching a market size of 2.5 million metric tons by 2030. The synergy between green hydrogen and ammonia production may create new opportunities for innovation and market expansion.

Growing Agricultural Sector Focused on Sustainability

The North America Green Ammonia Market is significantly influenced by the agricultural sector's increasing focus on sustainability. Farmers are increasingly seeking eco-friendly fertilizers to enhance crop yields while minimizing environmental impact. Green ammonia, as a sustainable nitrogen source, is gaining traction among agricultural producers. In 2025, the demand for green ammonia in the agricultural sector was estimated to account for nearly 40% of the total market share. This shift towards sustainable farming practices is likely to drive the North America Green Ammonia Market further, as agricultural stakeholders recognize the benefits of reducing reliance on traditional ammonia sources. The integration of green ammonia into farming practices could lead to a more resilient agricultural ecosystem.