Integration with Renewable Energy Sources

The Germany green ammonia market is increasingly integrating with renewable energy sources, which is pivotal for its growth. As of January 2026, Germany is one of the leading countries in renewable energy production, particularly in wind and solar power. This abundance of renewable energy is essential for the electrolysis process used in green ammonia production. By utilizing excess renewable energy during peak production times, manufacturers can produce green ammonia more cost-effectively. The synergy between renewable energy and green ammonia production not only enhances energy security but also contributes to the decarbonization of the energy sector. This integration is expected to create a more resilient energy system in Germany, where green ammonia can serve as a storage medium for excess renewable energy, thereby facilitating a transition to a sustainable energy future.

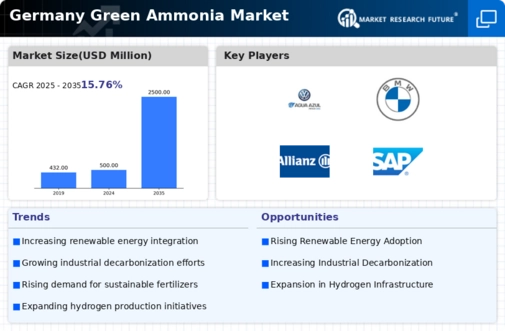

Growing Interest in Decarbonization Efforts

The Germany green ammonia market is experiencing a growing interest in decarbonization efforts across various sectors. As of January 2026, industries such as shipping, steel, and chemicals are increasingly recognizing the potential of green ammonia as a low-carbon alternative to fossil fuels. The European Union's Green Deal and Germany's commitment to reducing greenhouse gas emissions are driving this trend. Companies are exploring the use of green ammonia as a fuel source for ships and as a feedstock in chemical processes, which could significantly lower their carbon footprints. This shift towards decarbonization is likely to create new market opportunities for green ammonia producers in Germany, as industries seek to comply with stringent environmental regulations and meet sustainability goals. The emphasis on decarbonization is expected to further propel the growth of the green ammonia market in the coming years.

Increasing Demand from the Fertilizer Sector

The Germany green ammonia market is witnessing a notable increase in demand from the fertilizer sector, which is a primary consumer of ammonia. As of January 2026, the demand for sustainable fertilizers is on the rise, driven by the need for environmentally friendly agricultural practices. Traditional ammonia production methods are associated with high carbon emissions, prompting farmers and agricultural companies to seek greener alternatives. Green ammonia, produced using renewable energy sources, offers a sustainable solution that aligns with the growing emphasis on organic farming and reduced chemical usage. The fertilizer sector in Germany is projected to account for approximately 60% of the total green ammonia consumption by 2030, indicating a significant market opportunity for producers. This trend underscores the potential for green ammonia to play a crucial role in transforming agricultural practices in Germany.

Regulatory Framework and Government Initiatives

The Germany green ammonia market benefits significantly from a robust regulatory framework and proactive government initiatives aimed at promoting sustainable energy solutions. The German government has set ambitious targets to achieve carbon neutrality by 2045, which includes substantial investments in green hydrogen and ammonia production. Policies such as the National Hydrogen Strategy, launched in 2020, allocate billions of euros to support research, development, and infrastructure for green ammonia. As of January 2026, the government has committed to funding several pilot projects that demonstrate the feasibility of green ammonia in various applications, including transportation and energy storage. This regulatory support not only encourages private sector participation but also enhances public awareness of the environmental benefits associated with green ammonia, thereby driving market growth.

Technological Innovations in Green Ammonia Production

The Germany green ammonia market is experiencing a surge in technological innovations that enhance production efficiency and reduce costs. Advanced electrolysis methods, such as proton exchange membrane (PEM) technology, are being adopted to produce hydrogen from renewable sources. This hydrogen is then combined with nitrogen to create ammonia. As of January 2026, the production capacity of green ammonia in Germany is projected to reach approximately 1.5 million tons annually, driven by these innovations. Furthermore, the integration of artificial intelligence and machine learning in production processes is optimizing operational efficiency, thereby making green ammonia a more viable alternative to traditional ammonia. This technological evolution is likely to attract investments and foster collaborations among industry stakeholders, further solidifying Germany's position as a leader in the green ammonia market.