Rising Construction Activities

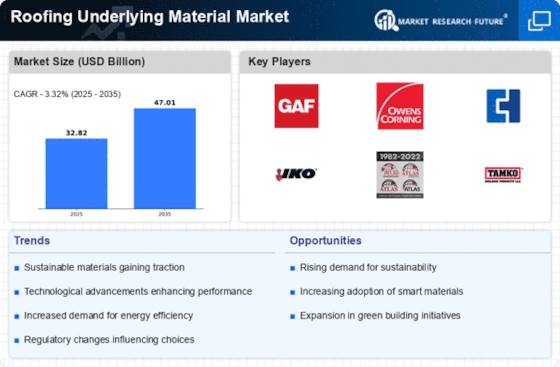

The Roofing Underlying Material Market is experiencing a surge in demand due to increasing construction activities across various sectors. As urbanization continues to expand, the need for residential and commercial buildings rises, leading to a higher requirement for roofing materials. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which directly influences the Roofing Underlying Material Market. This growth is driven by both new constructions and renovations, as property owners seek durable and efficient roofing solutions. Consequently, manufacturers are focusing on producing high-quality underlying materials that meet the evolving standards of the construction industry. The emphasis on energy efficiency and sustainability in building practices further propels the demand for innovative roofing solutions, thereby enhancing the overall market landscape.

Increased Awareness of Energy Efficiency

The Roofing Underlying Material Market is significantly influenced by the growing awareness of energy efficiency among consumers and builders. As energy costs continue to rise, there is a notable shift towards materials that enhance thermal performance and reduce energy consumption. In 2025, it is estimated that energy-efficient roofing solutions could account for over 30% of the total roofing market. This trend is prompting manufacturers to innovate and develop roofing underlying materials that not only provide structural support but also contribute to energy savings. The integration of reflective coatings and advanced insulation technologies in roofing materials is becoming increasingly common, as stakeholders recognize the long-term benefits of energy-efficient solutions. This heightened focus on sustainability and cost-effectiveness is likely to drive the Roofing Underlying Material Market forward, as more consumers prioritize energy-efficient options in their purchasing decisions.

Regulatory Support for Sustainable Practices

The Roofing Underlying Material Market is benefiting from regulatory frameworks that promote sustainable building practices. Governments are increasingly implementing policies that encourage the use of eco-friendly materials in construction, which directly impacts the roofing sector. In 2025, it is anticipated that more than 40% of new building projects will adhere to green building standards, thereby increasing the demand for sustainable roofing underlying materials. These regulations often include incentives for using materials that reduce environmental impact, such as recycled or renewable resources. As a result, manufacturers are compelled to adapt their product lines to comply with these standards, fostering innovation in the Roofing Underlying Material Market. This regulatory support not only enhances market growth but also aligns with the broader global movement towards sustainability in construction.

Growing Demand for Aesthetic Roofing Solutions

The Roofing Underlying Material Market is increasingly influenced by the rising demand for aesthetic roofing solutions. Homeowners and builders are placing greater emphasis on the visual appeal of roofing systems, which has led to a diversification of underlying materials that cater to aesthetic preferences. In 2025, it is estimated that the market for decorative roofing materials will grow by approximately 7% annually. This trend is prompting manufacturers to develop roofing underlying materials that not only provide structural integrity but also enhance the overall design of buildings. The integration of various colors, textures, and finishes in roofing materials is becoming more prevalent, as consumers seek to personalize their properties. This growing focus on aesthetics is likely to drive innovation and competition within the Roofing Underlying Material Market, as companies strive to meet the evolving tastes of consumers.

Technological Innovations in Material Production

The Roofing Underlying Material Market is witnessing a wave of technological innovations that are transforming material production processes. Advancements in manufacturing techniques, such as automation and the use of advanced composites, are enabling producers to create more durable and efficient roofing materials. In 2025, it is projected that the adoption of smart materials, which can respond to environmental changes, will increase significantly within the roofing sector. These innovations not only improve the performance of roofing underlying materials but also reduce production costs, making them more accessible to a wider range of consumers. As technology continues to evolve, the Roofing Underlying Material Market is likely to see a shift towards more sophisticated products that offer enhanced functionality and longevity, thereby attracting a diverse customer base.