Roofing System Repair and MRO Services Market Summary

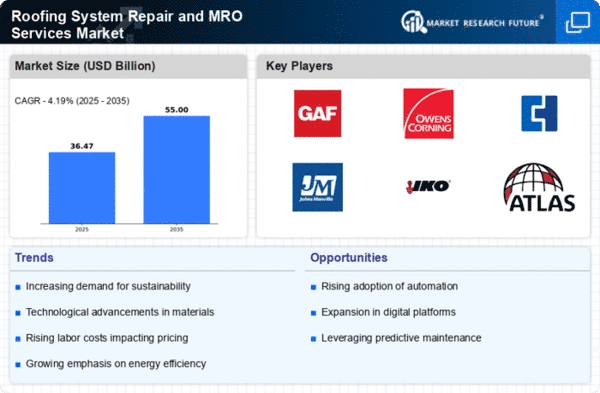

As per MRFR analysis, the Roofing System Repair and MRO Services Market was estimated at 35.0 USD Billion in 2024. The roofing industry is projected to grow from 36.47 USD Billion in 2025 to 55.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.19 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Roofing System Repair and MRO Services Market is experiencing a shift towards sustainability and technological integration.

- North America remains the largest market for roofing system repair and MRO services, driven by a robust construction sector.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rapid urbanization and increasing infrastructure investments.

- The residential roofing segment continues to dominate, while commercial roofing is witnessing the fastest growth due to rising demand for energy-efficient solutions.

- Key market drivers include increased urbanization and aging infrastructure, which are propelling the need for proactive maintenance and repair services.

Market Size & Forecast

| 2024 Market Size | 35.0 (USD Billion) |

| 2035 Market Size | 55.0 (USD Billion) |

| CAGR (2025 - 2035) | 4.19% |

Major Players

GAF (US), Owens Corning (US), CertainTeed (US), Johns Manville (US), IKO Industries (CA), Atlas Roofing (US), TAMKO Building Products (US), Sika AG (CH), Firestone Building Products (US)