North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Building Envelope and Roofing Engineering Services Market, holding a significant market share of 30.0% as of 2024. The region's growth is driven by increasing construction activities, stringent building codes, and a rising focus on energy efficiency. Regulatory incentives for sustainable building practices further catalyze demand, making it a hotbed for innovation in roofing technologies.

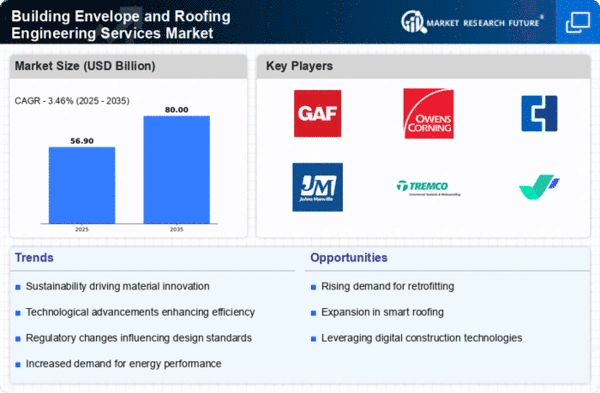

The competitive landscape is robust, with key players like GAF, Owens Corning, and CertainTeed leading the charge. The U.S. remains the largest market, supported by a strong infrastructure and investment in residential and commercial projects. The presence of established companies ensures a steady supply of advanced materials and services, positioning North America as a hub for cutting-edge building solutions.

Europe : Emerging Sustainability Focus

Europe is witnessing a transformative shift in the Building Envelope and Roofing Engineering Services Market, with a market size of 15.0% in 2024. The region's growth is propelled by stringent environmental regulations and a strong emphasis on sustainability. Governments are incentivizing green building practices, which is driving demand for innovative roofing solutions that enhance energy efficiency and reduce carbon footprints.

Leading countries like Germany, France, and the UK are at the forefront of this transition, with a competitive landscape featuring key players such as Sika and Rockwool. The European market is characterized by a mix of established firms and emerging startups focused on sustainable technologies. This dynamic environment fosters innovation and positions Europe as a leader in eco-friendly building solutions.

Asia-Pacific : Rapid Urbanization and Growth

The Asia-Pacific region is rapidly emerging in the Building Envelope and Roofing Engineering Services Market, with a market share of 8.0% in 2024. This growth is primarily driven by urbanization, increasing disposable incomes, and a surge in construction activities across countries like China and India. Regulatory frameworks are evolving to support sustainable building practices, further enhancing market demand.

China leads the region in terms of market size and growth, supported by significant investments in infrastructure and housing. The competitive landscape includes both local and international players, with companies like BASF and Kingspan making notable contributions. The region's diverse market dynamics present opportunities for innovation and expansion in roofing technologies.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa (MEA) region is characterized by its untapped potential in the Building Envelope and Roofing Engineering Services Market, holding a market share of 2.0% in 2024. The growth in this region is driven by increasing urbanization, infrastructure development, and a growing focus on energy-efficient buildings. Governments are beginning to implement regulations that promote sustainable construction practices, which is expected to catalyze market growth.

Countries like the UAE and South Africa are leading the charge, with significant investments in construction and real estate. The competitive landscape is evolving, with both local and international players vying for market share. As the region continues to develop, opportunities for innovative roofing solutions are expected to expand, making MEA a promising market for future growth.