Rising Construction Activities

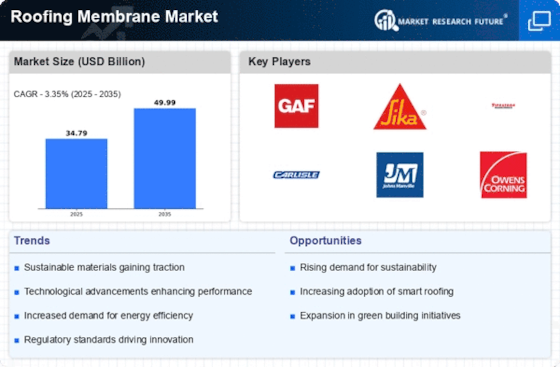

The Roofing Membrane Market is experiencing a surge in demand due to increasing construction activities across various sectors. Urbanization and population growth are driving the need for new residential and commercial buildings, which in turn necessitates effective roofing solutions. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to bolster the demand for roofing membranes, as builders seek durable and efficient materials to enhance the longevity and performance of roofs. Furthermore, the trend towards energy-efficient buildings is pushing architects and contractors to incorporate advanced roofing systems, thereby further stimulating the Roofing Membrane Market.

Increased Awareness of Energy Efficiency

The Roofing Membrane Market is significantly influenced by the growing awareness of energy efficiency among consumers and businesses. As energy costs continue to rise, there is a heightened focus on materials that can reduce energy consumption. Roofing membranes, particularly those with reflective properties, can help lower cooling costs in warmer climates. Data indicates that energy-efficient roofing solutions can reduce energy usage by up to 30%, making them an attractive option for both new constructions and renovations. This trend is likely to drive the adoption of advanced roofing membranes, as stakeholders seek to comply with energy efficiency standards and reduce their carbon footprint, thereby enhancing the overall appeal of the Roofing Membrane Market.

Growing Demand for Renovation and Retrofitting

The Roofing Membrane Market is witnessing a growing demand for renovation and retrofitting projects, particularly in aging infrastructure. As many buildings reach the end of their service life, property owners are increasingly investing in upgrades to enhance performance and extend lifespan. This trend is particularly pronounced in commercial buildings, where the need for modern roofing solutions is critical. Data suggests that the renovation market is expected to grow at a rate of 4% annually, driven by the need for improved energy efficiency and aesthetic appeal. Consequently, the Roofing Membrane Market stands to benefit from this trend, as property owners seek high-quality membranes that can provide long-term solutions for their roofing needs.

Technological Innovations in Roofing Materials

Technological advancements are playing a pivotal role in shaping the Roofing Membrane Market. Innovations such as self-healing membranes, advanced polymer formulations, and integrated solar technologies are enhancing the performance and functionality of roofing systems. These developments not only improve durability but also offer additional benefits such as energy generation and reduced maintenance costs. The market for roofing membranes is expected to witness a growth rate of around 6% annually, driven by these technological innovations. As manufacturers continue to invest in research and development, the Roofing Membrane Market is likely to see an influx of new products that cater to diverse consumer needs, thereby expanding market opportunities.

Regulatory Support for Sustainable Building Practices

The Roofing Membrane Market is benefiting from increasing regulatory support aimed at promoting sustainable building practices. Governments are implementing stricter building codes and standards that encourage the use of environmentally friendly materials. This regulatory landscape is pushing builders and developers to adopt roofing membranes that meet these new requirements. For instance, many regions are now mandating the use of reflective roofing materials to combat urban heat islands. As a result, the Roofing Membrane Market is likely to see a shift towards products that not only comply with regulations but also contribute to sustainability goals. This trend is expected to drive market growth as stakeholders align their practices with regulatory expectations.