North America : Market Leader in Services

North America leads the Roofing Equipment Maintenance and Repair Services Market, holding a significant share of 1.25B in 2024. The growth is driven by increasing construction activities, stringent building codes, and a rising focus on sustainable roofing solutions. Regulatory support for energy-efficient buildings further fuels demand, making this region a hub for innovation and service excellence.

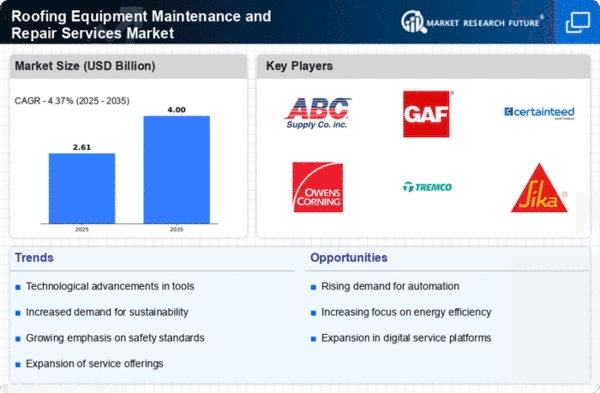

The competitive landscape is robust, with key players like ABC Supply Co. Inc., GAF Materials Corporation, and Owens Corning dominating the market. The U.S. is the primary contributor, supported by Canada, which also shows a growing demand for maintenance services. The presence of established companies ensures high service standards and innovation in roofing technologies.

Europe : Emerging Market Dynamics

Europe's Roofing Equipment Maintenance and Repair Services Market is valued at 0.75B, reflecting a growing trend towards renovation and maintenance of existing structures. The demand is driven by aging infrastructure, increasing environmental regulations, and a shift towards sustainable building practices. Government initiatives promoting energy efficiency are also significant catalysts for market growth.

Leading countries include Germany, France, and the UK, where major players like Sika AG and CertainTeed Corporation are actively expanding their services. The competitive landscape is characterized by a mix of local and international firms, ensuring a diverse range of offerings. The focus on quality and compliance with EU regulations enhances market dynamics.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of 0.4B, is witnessing rapid growth in the Roofing Equipment Maintenance and Repair Services Market. This growth is fueled by urbanization, increasing disposable incomes, and a surge in residential and commercial construction projects. Regulatory frameworks promoting safety and quality standards are also contributing to the market's expansion.

Countries like China, India, and Japan are leading the charge, with a competitive landscape featuring both local and international players. Companies such as IKO Industries Ltd. and Malarkey Roofing Products are establishing a presence, catering to the growing demand for reliable roofing solutions. The region's diverse market needs are driving innovation and service diversification.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 0.1B, is gradually emerging in the Roofing Equipment Maintenance and Repair Services Market. The growth is primarily driven by increasing investments in infrastructure and real estate, alongside a rising awareness of maintenance needs. Regulatory frameworks are evolving to support quality standards in construction, which is crucial for market development.

Leading countries in this region include the UAE and South Africa, where the demand for roofing services is on the rise. The competitive landscape is still developing, with local firms beginning to establish themselves alongside international players. This presents opportunities for growth and innovation in service offerings.